In keeping with supposed insider sources, Binance could also be getting ready to listing Pi Community on August 15, including bullishness to the near-term PI coin value outlook with potential recent demand.

The altcoin hovers round $0.42, down 86% from its all-time excessive because the market struggles to soak up the surplus provide of token unlocks with out a rise in demand to stabilise value strikes.

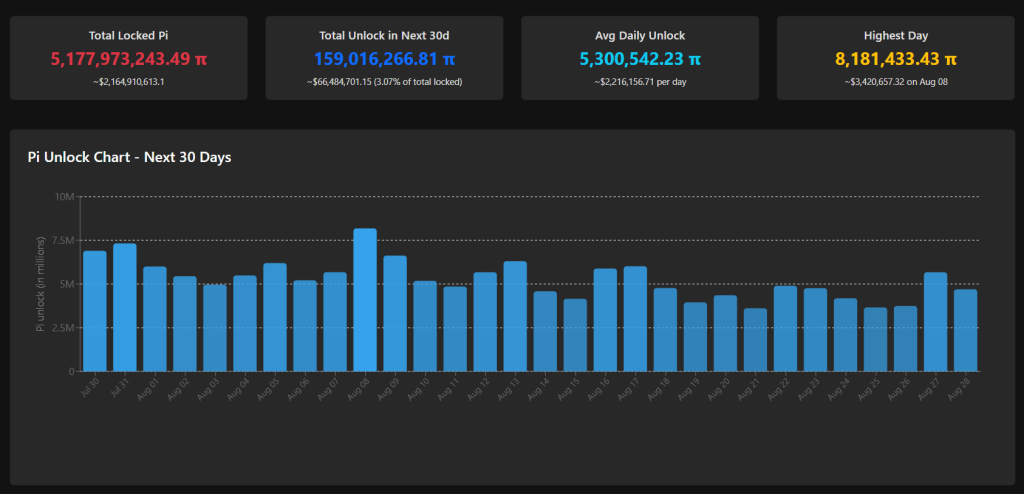

Inflationary pressures proceed to compound the consequences of short-term speculative buying and selling as tokens unlock at a median charge of $5.3 million PI per day, in line with PiScan.

Might Binance Checklist Pi Community on August 15?

Whereas skepticism on the supply’s credibility stays excessive throughout the neighborhood, Pi Barter Mall argues that previous “uncommon exercise” in Binance sizzling wallets may point out behind-the-scenes preparations.

A message is circulating extensively within the Pi neighborhood:#PiNetwork is alleged to be getting ready for a Binance itemizing on August 15

Uncommon $PI exercise detected in Binance sizzling wallets…

Group buzz is rising — is the silent big about to awaken?

Brace your self for potential… pic.twitter.com/GxU0HZaMBt— Pi Barter Mall/Pi Community 来购酷买 (@pibartermall) July 28, 2025

In early Could, two Binance-linked wallets grew to become energetic on the Pi Mainnet, sending 1 PI for what gave the impression to be Know Your Buyer (KYC) and Know Your Enterprise (KYB) verification.

Whereas neither Binance nor the Pi Community core workforce has issued an official assertion, merchants have been deciphering these strikes as a possible prelude to a list.

Regardless of rising optimism, analyst Kim H Wong has solid doubt on the probability of a list in a current x thread, citing key elementary limitations.

In keeping with Wong, Pi Community isn’t totally open-source, lacks a third-party safety audit, and should not have established direct collaboration with Binance, all of which block itemizing approval.

PI Coin Worth Prediction: Might a Binance Itemizing Push PI to $10

Binance itemizing rumors could possibly be what the PI coin value must keep away from a breakdown from the falling wedge sample forming since late June, as early reversal indicators start to flash.

Early reversal indicators are beginning to emerge.

The RSI has plunged to an oversold 24 as holders rush to chop losses, usually an indication of vendor exhaustion and a potential entry level for patrons.

Nonetheless, the MACD continues to widen beneath the sign line, pointing to sustained bearish stress and restricted buy-side momentum.

This places heavy deal with the present retest of the 1.168 Fibonacci extension at $0.41, the ultimate main assist earlier than a deeper breakdown.

If renewed itemizing hypothesis sparks a sentiment shift, Pi Coin may rebound towards the 0.5 Fibonacci stage, a key accumulation zone the place stronger demand sometimes surfaces.

A breakout from there may goal the late June excessive of $0.665, representing a possible 62% upside, although that transfer might rely closely on a Binance itemizing to gas quantity.

Whereas the long-term $10 goal stays a sizzling matter amongst holders, reaching it will require a serious leap in adoption, continued improvement, and broader trade assist to evolve Pi past its present speculative section.

If $0.41 fails to carry, PI may fall right into a low-liquidity zone with little historic shopping for curiosity, rising the chance of accelerated draw back.

How Merchants Are Cashing in on Bearish Cash Like PI — With out Holding the Bag

Pi Community spot merchants are caught with a tricky selection: promote at a loss or preserve holding whereas the value drifts decrease with no clear reversal in sight.

However leverage merchants don’t wait — they capitalize on each ups and downs.

With CoinFutures, the brand new leveraged buying and selling platform from the workforce behind CoinPoker, anybody can make the most of market strikes with out proudly owning the token.

It’s easy: you select whether or not the value will go up or down, determine your stake, and apply leverage, with choices as much as 1000x.

Whether or not the market pumps or dumps, CoinFutures places you in management.

This leverage is what multiplies your potential income — and sure, potential losses too.

However with built-in stop-loss instruments and the power to money out at any time, you keep in management of your danger and publicity.

For spot merchants, hitting 1000x returns takes an ideal bull market and numerous persistence.

For leverage merchants on CoinFutures, it’s a calculated transfer you can also make at this time.

You’ll be able to check out CoinFutures by visiting the official web site, with no KYC or trade accounts required to enroll.

The submit Pi Coin Worth Prediction: Binance Itemizing Rumors Warmth Up Once more – Might PI Skyrocket Previous $10? appeared first on Cryptonews.