Ethena’s $ENA is defying crypto’s sideways grind with a 37% worth improve this week—however the rally’s subsequent transfer hangs within the steadiness. After a pointy breakout, patrons are shedding steam at a key resistance degree, leaving merchants looking forward to affirmation or a swift reversal.

The token’s momentum aligns with broader protocol progress, together with main ecosystem expansions and contemporary capital inflows. But technical indicators recommend the explosive transfer might have renewed gasoline to maintain its climb.

Ethena Expands DeFi Attain with Main Partnerships and $360M Treasury Increase

Ethena has built-in $ENA into the DeFi ecosystem by way of partnerships with blue-chip protocols like Aave, Curve Finance, and Uniswap, unlocking new staking and yield farming alternatives that additional align incentives for token holders.

As a crypto-native artificial greenback protocol on Ethereum, Ethena facilitates the minting of USDe through delta-neutral hedging methods, offering scalable, censorship-resistant greenback publicity that bypasses conventional banking dependencies.

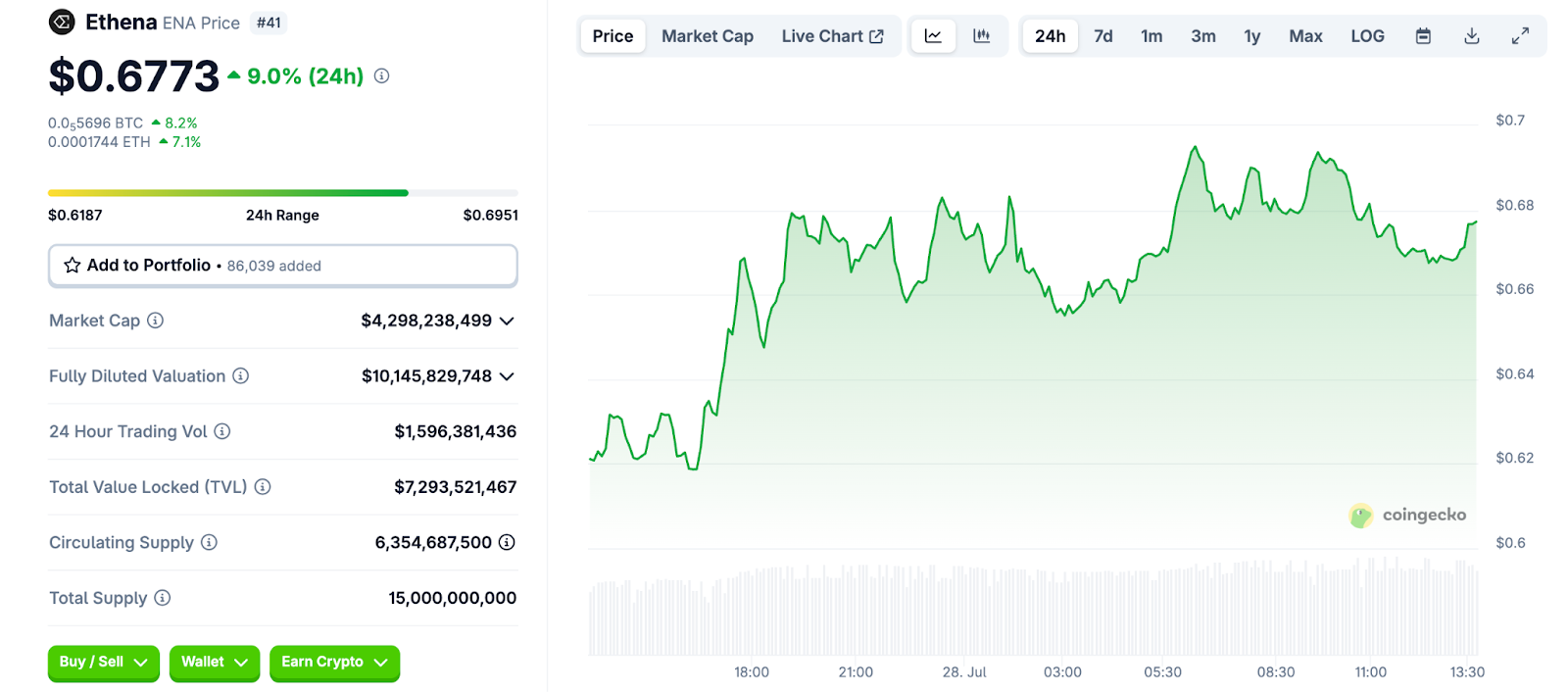

The protocol’s distinctive providing has attracted a Complete Worth Locked (TVL) of $7.726 billion throughout Ethereum and TON, reflecting a robust capital dedication and yield-bearing alternatives. These milestones additionally solidify the protocol’s place as one of many main DeFi stablecoin networks.

It generated $433.32 million in annualized charges, translating to $97.8 million in annualized earnings for the treasury. Moreover, $ENA liquidity on Uniswap V3 totaled $18.76 million, making certain market depth for governance token buying and selling.

On July 22, 2025, Ethena unveiled a $360 million treasury initiative to buy locked tokens, to reinforce treasury resilience and protocol stability, together with plans to record its inventory on the Nasdaq.

StablecoinX Inc. @stablecoin_x has introduced a $360 million capital elevate to buy $ENA and can search to record its Class A standard shares on the Nasdaq World Market underneath the ticker image "USDE", which features a $60 million contribution of ENA from the Ethena Basis… pic.twitter.com/sgfD8P9m05

— Ethena Labs (@ethena_labs) July 21, 2025

Shortly thereafter, the undertaking partnered with Anchorage Digital to launch USDtb, a federally regulated $1.5 billion stablecoin underneath the brand new GENIUS Act.

ICYMI, Anchorage Digital has shaped a strategic partnership with @ethena_labs to convey USDtb to the U.S. -the first-ever stablecoin with a transparent pathway to turning into compliant with the just lately enacted GENIUS Act.

Launching through the Anchorage Digital stablecoin issuance platform,… pic.twitter.com/tX6hAcH9bM— Anchorage Digital

(@Anchorage) July 26, 2025

Including to those bullish strikes, BitMEX co-founder Arthur Hayes added 2.16 million ENA (about $1.06 million) to his pockets, bringing his whole holdings to 7.76 million ENA, which additional fueled market optimism.

Arthur Hayes(@CryptoHayes) purchased 2.16M $ENA($1.03M) right now from #Binance, #GalaxyDigital, #Flowdesk, and at the moment holds 7.76M $ENA($3.73M).https://t.co/1HymJROJmL pic.twitter.com/uB1DWSU2JP

— Lookonchain (@lookonchain) July 25, 2025

Analysts have interpreted these actions throughout the protocol as a strategic pivot towards institutional integration and regulatory alignment, broadening Ethena’s ecosystem attain.

With Ethena’s market cap climbing previous $4.2 billion and USDe itself surpassing $7.5 billion in circulating worth, the protocol’s diversified income streams and rising institutional footprint recommend that $ENA stays well-positioned to increase its present momentum, offered markets stay receptive to its evolving governance and fee-sharing mechanisms.

$ENA/USDT Exams Breakout Stability as Purchase-Facet Aggression Wanes

After weeks of methodical ascent inside a rising parallel channel, $ENA/USDT has managed to punch by way of the higher boundary. However the breakout isn’t unfolding with the power it initially promised.

What began as a clear transfer above resistance has begun to stall simply beneath the $0.69 deal with, elevating doubts concerning the sustainability of this push.

At first, patrons had been in management. Order stream confirmed sturdy demand, with cumulative quantity hitting 119M and optimistic deltas. However issues modified close to $0.67–$0.69.

Two straight 4-hour candles printed destructive deltas (-5.69M and -5.17M), clear indicators of sellers stepping in. The quantity additionally appears to be shrinking. This isn’t simply hesitation; it seems to be actual resistance.

On the chart degree, worth continues to be buying and selling above the channel, however solely simply. The candles at the moment are shrinking, with lengthy wicks indicating rejection.

In the meantime, the RSI has hovered simply over 70 for 3 straight periods, indicating extended overbought circumstances, whereas the MACD strains have begun to converge close to the highest.

There’s no invalidation but. However the complexion has modified. What was an explosive breakout now appears to be like extra like a levitation act—patrons are conserving the worth afloat, however there’s no improve to mark a real shift in regime.

If bulls can’t reclaim initiative with a robust quantity re-entry, this might flip corrective quick. A drift again into the channel would expose $ENA to the $0.63–$0.60 zone, the place the final true demand cluster resides.

The breakout could also be legitimate, however the lack of follow-through suggests the market is already second‑guessing it.

The publish Ethena’s $ENA Rockets 37% – Will Arthur Hayes’ $1M Guess Hold the Rally Alive? appeared first on Cryptonews.