BitGo, one of many US’ largest crypto custody corporations, has confidentially filed for a public itemizing, the corporate stated on Monday.

The transfer positions it amongst a rising record of digital asset corporations seeking to faucet into rising investor urge for food and favorable political tailwinds.

The Palo Alto-based startup, based in 2013, focuses on securing and managing digital belongings for institutional shoppers. As demand for crypto custody surges, BitGo’s belongings below custody have grown to $100b, up from $60b within the first half of 2025, the corporate stated.

Its buyers embody Goldman Sachs, DRW Holdings, Redpoint Ventures and Valor Fairness Companions.

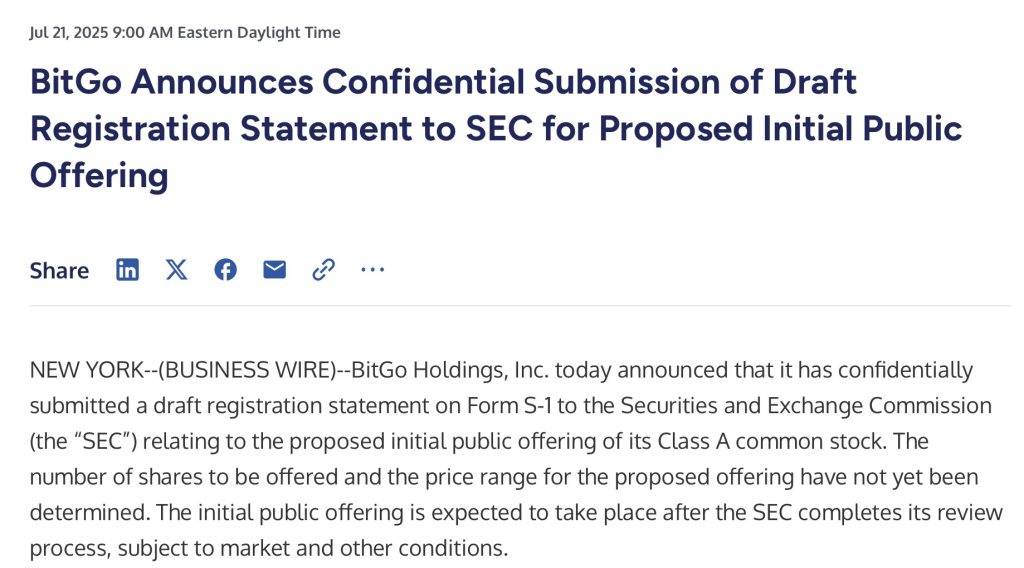

Picture Supply: BitGo assertion

Crypto Listings Warmth Up as BitGo Recordsdata Amid $4T Market Growth

Whereas particulars on the IPO stay below wraps, BitGo famous that the variety of shares and value vary are but to be decided. The agency’s choice to go public follows a broader development within the sector, the place regulatory readability and institutional inflows have revived momentum for crypto listings.

The crypto business’s whole market worth just lately surged previous $4 trillion for the primary time, fueled by a record-breaking rally in Bitcoin, which climbed above US$120,000.

On the identical time, political assist has grown extra seen. Final week, US President Donald Trump signed the primary federal laws to manage stablecoins, calling it a “large step to cement American dominance of worldwide finance and crypto expertise.”

BitGo Expands Buying and selling Providers, Faucets Institutional Demand Forward of IPO

His crypto-friendly strikes have emboldened a number of corporations within the house. Alternate operator Bullish just lately disclosed its IPO plans, whereas Grayscale and Gemini, based by the Winklevoss twins, have additionally filed confidentially for listings. Circle, the issuer of USDC, debuted publicly in June with a powerful market reception.

BitGo is now seeking to experience this wave. Earlier this 12 months, it launched an over-the-counter buying and selling desk for digital belongings to fulfill rising demand from hedge funds and different institutional gamers. The desk provides spot and choices buying and selling in addition to lending for margin trades.

The agency has additionally been increasing internationally. It just lately secured regulatory approval below the European Union’s Markets in Crypto-Property (MiCA) framework, permitting it to increase its providers throughout the bloc. That approval marks a key step in its plan to develop past the US market.

Financial institution Constitution Bid Indicators Broader Ambitions Past Crypto Custody

Additional, BitGo is exploring a deeper foothold in conventional finance. In Might, the corporate was reported to be amongst a handful of crypto corporations searching for a US financial institution constitution, pending regulatory readability. If granted, the transfer would permit BitGo to broaden its monetary choices throughout the current banking system.

In 2023, BitGo raised $100m at a valuation of $1.75b. Since then, it has quietly constructed a presence as a key infrastructure participant within the crypto ecosystem.

With market situations turning extra favorable and political assist rising, BitGo’s IPO might mark a pivotal second for the corporate, and for the broader push to deliver digital asset corporations into the monetary mainstream.

The publish BitGo Eyes Public Debut as Professional-Crypto Momentum Builds Beneath Trump appeared first on Cryptonews.