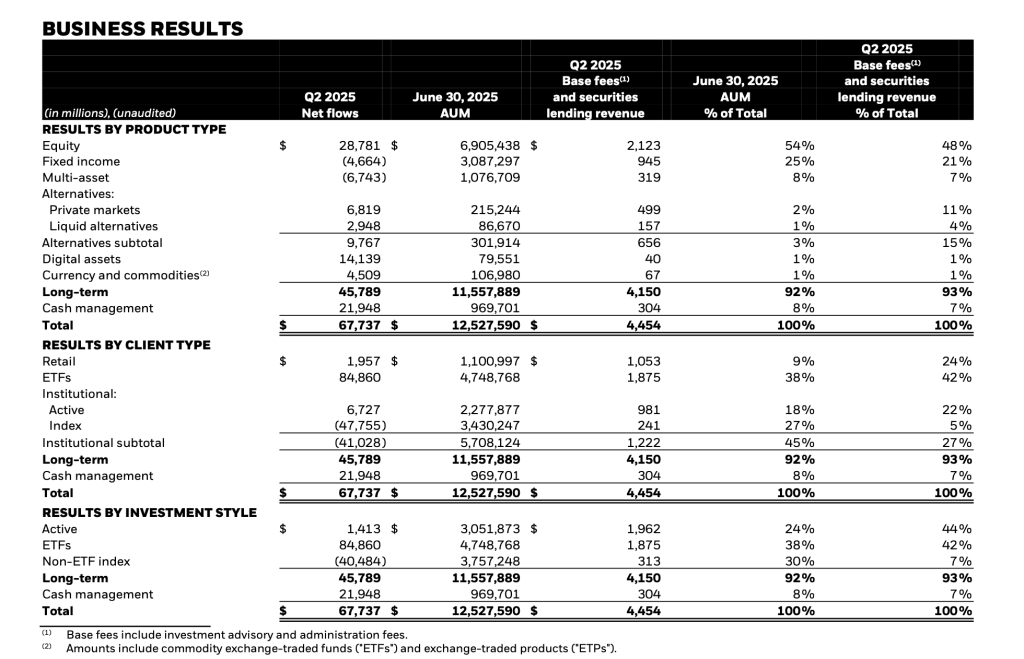

BlackRock reported $14.1 billion in digital asset internet inflows for the second quarter of 2025, pushing the agency’s complete property underneath administration (AUM) on this section to $79.6 billion.

Though digital property nonetheless characterize simply 1% of BlackRock’s $12.5 trillion in complete AUM, the class is rising as one in every of its fastest-growing product traces.

Digital property contributed massively to BlackRock’s broader ETF efficiency. Throughout the agency’s $85 billion in complete ETF inflows throughout Q2, digital merchandise alone accounted for $14 billion.

12 months-to-date, digital asset internet inflows have reached $17 billion, displaying persistent institutional curiosity regardless of a posh macroeconomic backdrop.

Income Contribution Stays Modest—For Now

Digital property generated $40 million in base charges and securities lending income in Q2 2025, additionally accounting for 1% of BlackRock’s complete income from funding advisory and administration providers.

Whereas modest in comparison with conventional asset courses, the determine displays a rising stream of yield-generating publicity from crypto-related merchandise.

CEO Larry Fink attributed among the agency’s efficiency momentum to digital property, together with customized methods and technology-led platforms like Aperio.

BlackRock Reveals Lengthy-Time period Dedication to Digital Finance

In an announcement accompanying the outcomes, CEO Larry Fink emphasised the rising position of digital property in attracting a brand new technology of traders.

“We’re attracting a brand new and more and more international technology of traders via issues like our digital property choices,” he mentioned.

Digital property are at the moment reported underneath the ETF class, alongside core fairness and glued earnings. Nonetheless, with digital property contributing practically 31% of other product flows in Q2, they’re changing into a key pillar of the agency’s different funding technique.

Whereas digital property stay a small slice of the general portfolio, BlackRock’s rising involvement in tokenized finance, ETFs, and associated infrastructure suggests a long-term dedication to institutional crypto adoption.

“These are simply the early days in our subsequent part of even stronger development,” Fink added.

BlackRock Shares Tumble

BlackRock shares fell greater than 6% after a significant institutional consumer primarily based in Asia withdrew $52 billion from its index funds in the course of the second quarter, the Wall Street Journal reported.

The withdrawal illustrates the volatility that even the world’s largest asset supervisor can face from a small variety of giant shoppers, significantly in passive funding autos.

Nonetheless, BlackRock’s total efficiency remained sturdy, with complete property underneath administration climbing to a report $12.53 trillion.

In response to the WSJ, internet earnings rose 6.5% year-over-year to $1.59 billion, indicating operational resilience within the face of short-term outflows.

The agency additionally reported elevated income pushed by increased base charges and robust flows into lively methods and ETFs, suggesting that BlackRock continues to diversify its development drivers past conventional index merchandise.

The submit BlackRock’s Q2 Digital Asset Inflows Attain $14B, Complete AUM Hits $79.6B appeared first on Cryptonews.