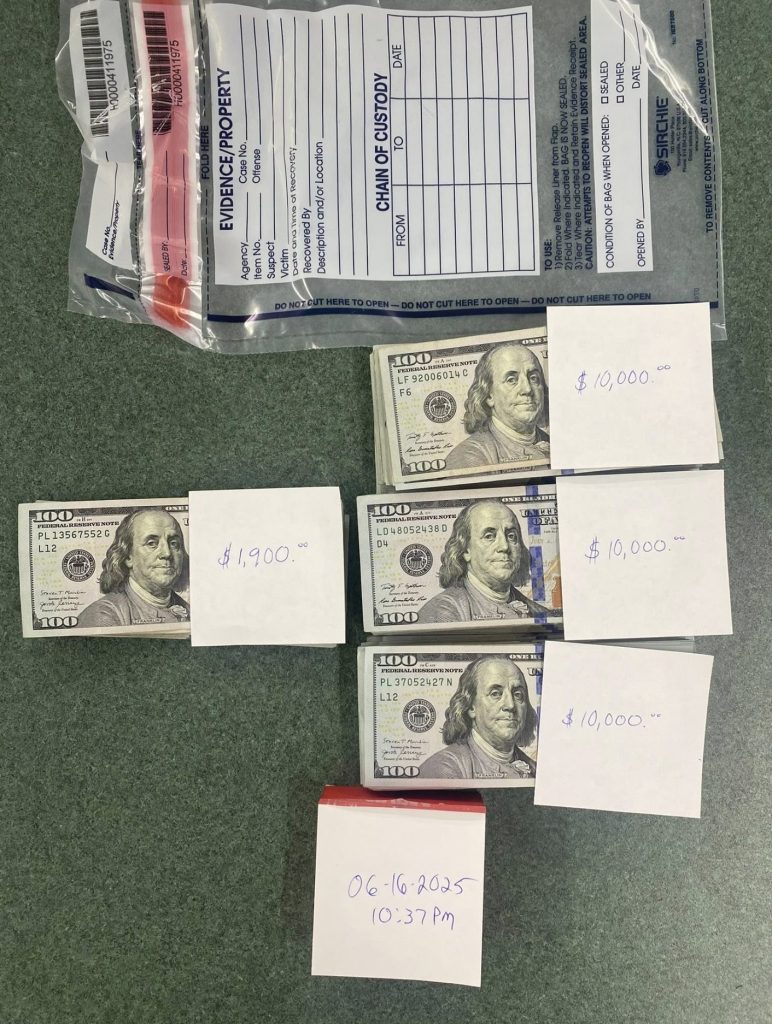

When a household was scammed out of $25,000 at a Bitcoin ATM in Texas, regulation enforcement brokers didn’t fiddle.

Detectives used energy instruments to interrupt into the machine and get well the bodily money inside — with a grand complete of $31,900 seized.

Though serving to a fraud sufferer is definitely to be applauded, this has a really feel of robbing Peter to pay Paul. Such an act doesn’t carry the scammer accountable to justice — it simply harms the small enterprise proprietor who owns the machine.

Nonetheless, tales like this powerfully illustrate the crackdown on Bitcoin ATMs that’s happening throughout America proper now.

Spokane in Washington State has really banned them altogether, however different states and cities are as an alternative proposing legal guidelines that will make it more durable for fraudsters to empty the life financial savings of impressionable shoppers.

Over in Illinois, any cash-to-crypto conversions facilitated by means of these ATMs would want to take a observe of the handle the place funds have been despatched. In concept, this might assist detectives observe down scammers at a later date, but it surely’s seemingly many seasoned criminals will use obfuscation instruments to cowl their tracks.

Maybe a extra smart proposal comes from Vermont, which has handed a regulation that imposes every day transaction limits of $1,000 on Bitcoin ATMs. This may go an extended solution to limiting the sum of money victims lose.

In the meantime, the likes of Nebraska have moved to license ATM operators. Not solely does this imply they should present quarterly experiences with transaction information, however charges are capped at 18% to stop impressionable shoppers from being ripped off.

A Rising Drawback

The Federal Commerce Fee has made its views on Bitcoin ATMs clear — describing them as a “cost portal for scammers.”

Official figures present fraud losses from these machines hit $12 million in 2020, surging virtually tenfold to $114 million by 2023. Incomplete figures confirmed losses topped $66 million within the first six months of 2024 alone, indicating it was set to be one more record-breaking yr.

FTC analysis additionally sheds gentle on how victims are lured in, how a lot they lose, and who tends to be essentially the most susceptible. Scammers usually try to impersonate governments and companies, or fake they’re from tech help. Median losses stand at an “exceptionally excessive” $10,000, with the federal government physique including:

“Within the first half of the yr, folks 60 and over have been greater than 3 times as seemingly as youthful adults to report a loss utilizing a BTM. In actual fact, greater than two of each three {dollars} reported misplaced to fraud utilizing these machines was misplaced by an older grownup.”

Put one other means, there are extra victims over 60 than in all different age teams mixed.

Lawmakers within the U.S. Senate are additionally making an attempt to construct upon the tightened legal guidelines being rolled out at a state and native stage — led by Illinois Senator Dick Durbin.

He’s launched the Crypto ATM Fraud Prevention Act, which might usher in literate measures designed to guard the general public — whereas making an attempt to restrict inconvenience for law-abiding customers.

New customers could be prevented from spending greater than $2,000 a day at one in every of these machines, rising to $10,000 in a 14-day interval. Operators would additionally have to have an in depth dialog every time a brand new person is making an attempt to finish a transaction with a price of over $500. Crucially although, they might even be entitled to refunds if a police report is filed inside 30 days.

Studying between the strains, it is a invoice that places the onus on ATM operators to keep watch over what’s occurring of their shops — and intervene if one thing appears to be like suspicious.

The clock is ticking to get the Crypto ATM Fraud Prevention Act signed into regulation. Durbin has confirmed that he gained’t be looking for re-election in the course of the midterms in 2026, with the 80-year-old Democrat resigning after a long time of service.

Durbin additionally provided an modification when the GENIUS Act was winding its means by means of the Senate, warning:

“Sufficient is sufficient. I urge my colleagues on either side of the aisle: take heed to the folks you signify, notably the senior residents who’re shedding their life financial savings to those scams, and notice that with 30,000 crypto ATMs throughout the nation, an increasing number of of this may happen.”

It stays to be seen whether or not any of the efforts to stop crypto ATM losses will make a distinction. As Bitcoin’s worth rises, and flirts with all-time highs, a larger variety of opportunistic fraudsters will take the chance to strike.

The publish Why the U.S. is Clamping Down on Bitcoin ATMs appeared first on Cryptonews.