Binance continues to say itself as the highest trade for altcoin buying and selling, main the market in altcoin deposit exercise, in accordance with a brand new report from on-chain analytics agency CryptoQuant.

Binance leads crypto inflows.

Through the Nov–Dec rally, it noticed 59K altcoin deposit txs/day vs. 26K on Coinbase.

This week: 384K USDT txs on TRON, greater than Bybit + HTX mixed. pic.twitter.com/zba38IxNHe— CryptoQuant.com (@cryptoquant_com) June 17, 2025

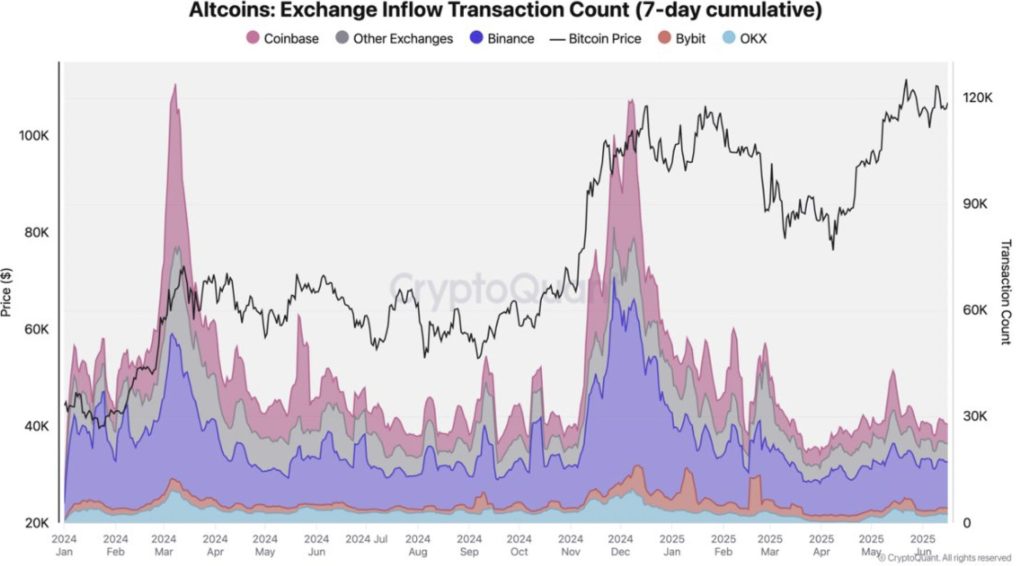

On the peak of final 12 months’s November-to-December altcoin rally, Binance dealt with as many as 59,000 deposits in a single day—greater than double Coinbase’s roughly 26,000 and much above the 24,000 whole going to all different exchanges mixed.

Even in calmer market circumstances, Binance maintains its lead, averaging roughly 13,000 altcoin influx transactions per day. In distinction, Coinbase averages 6,000, and different platforms common round 10,000.

Altcoin inflows sometimes improve within the wake of robust market rallies, suggesting merchants are transferring belongings onto exchanges to lock in earnings. These spikes typically coincide with native worth peaks and elevated speculative exercise, stories CryptoQuant.

Binance’s sustained influx dominance is because of its broad altcoin choices and deep liquidity, making it the popular vacation spot for each retail and institutional merchants during times of heightened market momentum.

Stablecoin Exercise on Ethereum Favors Binance

Binance additionally holds a commanding place in stablecoin inflows on the Ethereum community, significantly in transactions involving USDT and USDC, stories CryptoQuant.

Over a just lately noticed interval, Binance acquired round 53,000 Ethereum-based stablecoin transactions, in comparison with 42,000 for Coinbase, 28,000 for Bybit, and simply 11,000 for OKX. This development demonstrates Binance’s standing as the first entry level for dollar-denominated capital coming into the crypto market through Ethereum.

Stablecoin inflows are sometimes seen as a precursor to elevated buying and selling exercise, as they characterize capital being parked on exchanges for potential deployment.

Binance’s dominance on this phase signifies robust dealer and investor confidence, additional reinforcing its place because the go-to platform for liquidity and execution.

TRON Community Knowledge Additional Confirms Binance’s Edge

The development extends to the TRON community, the place Binance constantly receives the best quantity of USDT deposits. Up to now seven days alone, Binance registered roughly 384,000 USDT influx transactions, outpacing Bybit with 321,000 and HTX with 163,000.

With its low charges and fast transaction instances, TRON has turn out to be the go-to rail for transferring stablecoins. Most of that site visitors finally ends up at Binance, displaying simply how firmly the trade has positioned itself in stablecoin buying and selling.

CryptoQuant notes that exchanges with dominant stablecoin inflows are sometimes positioned to learn from elevated buying and selling quantity and person belief.

Binance’s constant lead throughout each Ethereum and TRON networks confirms its central function in world crypto liquidity and capital allocation.

The submit Binance Leads in Altcoin and Stablecoin Deposits Throughout ETH and TRON: CryptoQuant appeared first on Cryptonews.