It’s been a wild run, and now the window is nearly closed. Solaxy ($SOLX) has raised over $44.8 million, and with simply 10 days remaining, that is the ultimate likelihood to get in earlier than doable top-tier alternate listings.

As Solana’s ($SOL) first Layer-2, Solaxy isn’t simply one other improve – it’s the backup engine the chain must scale. By dealing with overflow from the bottom layer, Solaxy makes Solana extra reliable throughout high-demand sectors like meme cash, gaming, and DeFi.

And the timing couldn’t be higher. Whereas Elon and Trump had been heating up for what can be a volcanic eruption, institutional capital has been flooding into Solana.

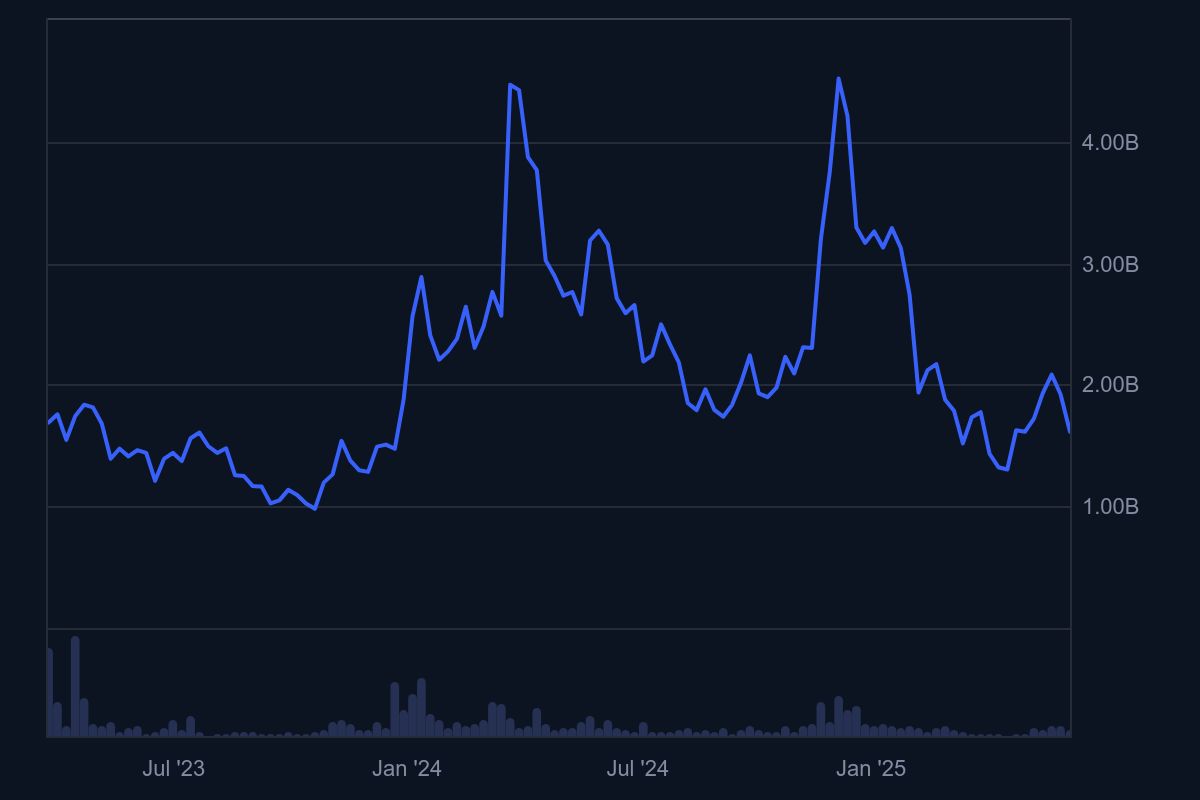

Over $1 billion in new Solana publicity was simply introduced via securities choices and liquid staking methods. Whereas $SOL hasn’t reclaimed its all-time excessive but, good cash is positioning forward of the subsequent wave.

Should you consider Solana’s subsequent surge is coming, Solaxy is the way it scales to fulfill it. Tokens are nonetheless priced at $0.0011746, growing each two days till the presale ends.

Missed $SOL when it was low-cost? $SOLX may be your second shot.

Institutional Strikes Sign Solana’s Subsequent Breakout – And Solaxy’s Timing Couldn’t Be Higher

Confidence amongst main gamers in Solana is accelerating. One of many latest to enter the world is SOL Methods, a Canada-listed agency that simply filed to lift as a lot as $1 billion in fairness and debt to deepen its Solana publicity.

This follows a $500 million convertible observe increase, with the primary $20 million already used to buy 122,000 $SOL tokens.

SOL Methods has filed a preliminary base shelf prospectus, permitting for as much as $1B USD in potential financings.

This submitting will increase our flexibility to maneuver decisively as strategic alternatives emerge throughout the Solana ecosystem.

In blockchain, timing issues. Our aim is… pic.twitter.com/piBw3R22SF— SOL Methods (CSE: HODL | OTCQB: CYFRF) (@solstrategies_) Could 27, 2025

In the meantime, DeFi Improvement Corp grew to become the primary public firm to put money into Solana-based liquid staking tokens (LSTs). Utilizing Sanctum’s infrastructure, they launched dfdvSOL, permitting customers to stake $SOL whereas retaining it liquid for DeFi participation.

Much more bullish: Solana ETF filings at the moment are awaiting approval, setting the stage for a broader institutional inflow.

All indicators level to Solana gearing up for a significant cycle. And this time, it has Solaxy to deal with the surge in exercise – a scaling resolution prepared when it’s wanted.

Solaxy: Scaling Solana From the Inside Out

Solaxy was constructed to increase Solana’s capabilities – not by changing something, however by offloading community stress and enabling quicker, cheaper transactions. It’s the primary Layer-2 engineered for the ecosystem’s most demanding use instances: meme coin buying and selling, real-time gaming, and high-frequency DeFi.

On the core is roll-up bundling, compressing 1000’s of transactions into fewer submissions, chopping prices, and enhancing effectivity. A modular structure permits parallel processing so transactions don’t get caught in queues.

It additionally options off-chain enhanced logic, letting complicated computations like swap engines and prediction fashions run off-chain and anchor outcomes again on-chain, maximizing efficiency whereas preserving safety and finality.

Now, that infrastructure is stay on testnet.

The Solaxy Testnet lets customers discover what the community can do. You’ll be able to:

- Bridge SOL from Solana Devnet by way of bridge.solaxy.io

- Deploy contracts utilizing Solana’s native toolchain

- Switch property throughout the rollup

- Monitor exercise via the Solaxy Explorer

Hey Solaxy Group it’s right here.

The Solaxy Testnet is LIVE. Your first likelihood to work together with Solana’s first Layer 2 and expertise the velocity, scale, and ease Solaxy brings.Join by way of Backpack Pockets:https://t.co/FBrV3FohC8

You’ll be able to:

– Bridge SOL (Solana… pic.twitter.com/FQY9AIwSdx— SOLAXY (@SOLAXYTOKEN) June 2, 2025

The Igniter Protocol and DEX buying and selling are coming quickly, however the core engine is already operating. That is not a idea. Solaxy is actual, practical, and able to scale what’s subsequent.

How Far Can Solaxy Go? Take a look at What Arbitrum Did for Ethereum

For a glimpse of what Solaxy may change into, take a look at what Layer-2s like Arbitrum ($ARB), Optimism ($OP), and Base did for Ethereum. Arbitrum alone reached a $1.5 billion market cap post-launch, and that was in a crowded L2 area.

Solana has by no means had a Layer-2 like this – till now.

Solaxy is arriving earlier than Solana hits its subsequent all-time excessive. That’s fortuitous positioning. With $44.8 million already raised, even a fraction of the expansion Arbitrum skilled may translate to 10x to 50x upside – particularly as institutional capital continues to circulation in.

For early contributors, this isn’t nearly Solaxy. It’s about Solana lastly scaling the way in which it was at all times meant to – with Solaxy main the cost.

The way to Be a part of the Solaxy Presale Earlier than Time Runs Out

To get in, simply head over to the Solaxy web site, join a supported pockets, and purchase $SOLX on the present price earlier than the value will increase. As soon as bought, tokens will be staked instantly, with the protocol at present providing a dynamic 90% APY, adjusting based mostly on pool exercise.

For the most effective expertise, use Greatest Pockets, the really useful self-custody choice with full presale integration and multichain assist.

Keep within the loop by becoming a member of the Solaxy neighborhood on Telegram and X.

The countdown is on.

The submit Elon Explodes However Solaxy’s About to Detonate – $44.8M Raised, 10 Days Left to Get in Earlier than CEX Surge appeared first on Cryptonews.