All prime 10 cash and 99 of the highest 100 cash per market cap have seen their costs improve since this time yesterday. Per analysts, the rally is the results of institutional adoption, rising regulatory readability, and beneficial macroeconomic elements. On the identical time, the cryptocurrency market capitalization is unchanged over the previous day, at present standing at $3.58 trillion. The overall crypto buying and selling quantity is at $95 billion – the bottom it’s been in days.

TLDR:

Crypto Winners & Losers

On the time of writing, all the highest 10 cash per market capitalization have appreciated over the previous day. Bitcoin (BTC) is up 2.3%, now buying and selling at $110,080. The coin hit its all-time excessive of $111,814 on 22 Might, falling 1.6% since. Its present degree is its intraday excessive.

Ethereum (ETH) appreciated 3.6%, now altering palms at $2,581. Its every day excessive is $2,585.

The class’s greatest performer, for the sixth day in a row, is Cardano (ADA). It’s up 5.1% to $0.7736.

Cardano’s Ouroboros Leios improve is at present in growth, with the launch anticipated subsequent 12 months. It ought to considerably enhance the chain’s scalability and permit the community to deal with tens of hundreds of transactions per second.

In the meantime, Cardano supporters are engaged on increasing the ecosystem.

Im honoured to have the ability to characterize our vibrant group, and having the ability to to convey extra publicity to the Cardano ecosystem inside the area as we increase additional. Let's construct collectively!

Extra thrilling updates to comply with.— Kavinda Kariyapperuma (@OfficialKavinda) Might 23, 2025

Of the highest 100 cash, just one is purple at the moment. Tokenize Xchange (TKX) has decreased by 2.2% to the present value of $32.77.

On the identical time, Hyperliquid (HYPE) is that this class’s highest gainer. It’s up 11.7% to $38.88.

Nevertheless, the crypto market is evidently nonetheless extremely influenced by the macroeconomic developments. It’s significantly, even worryingly so, delicate to US coverage shifts. On Sunday, US President Donald Trump determined to delay the introduction of fifty% tariffs on EU imports till 9 July. This has eased the overall market considerations round a possible commerce struggle. On the identical time, the capital is migrating into danger belongings.

A set date is an efficient signal. In the event that they seal a deal by July 9, corporations get clear guidelines on tariffs and tech commerce, which helps unlock recent funding on either side of the Atlantic.

— ForceField (@ForceFieldX) Might 26, 2025

Bitcoin is on the Path to $150,000

In accordance with Ruslan Lienkha, chief of markets at YouHodler, “Bitcoin already possesses ample inner catalysts” to achieve the $150,000 degree. Elements that present robust structural assist embody post-halving provide constraints, continued institutional adoption, and the enlargement of Bitcoin ETF inflows.

“Given these fundamentals, even a secure and reasonably constructive macroeconomic atmosphere over the medium time period may propel Bitcoin towards the $150K mark.”

Moreover, Lienkha famous that almost all of BTC’s free float is in retail wallets. Due to this fact, retail buyers stay dominant in market dynamics. Nevertheless, “it’s more and more widespread to see Bitcoin allotted as a small however strategic part in diversified funding portfolios.” This reveals that its adoption amongst establishments continues to be within the early phases, however there’s rising recognition of the coin as a official asset class and a possible long-term retailer of worth.

Final Friday, US Spot #Bitcoin ETFs simply recorded one of many largest web constructive flows YTD – 7,869 $BTC – marking the most important every day influx since April 29. The 7-day SMA can be trending larger, signaling a sustained uptick in institutional demand: https://t.co/DVHnnJp9lu pic.twitter.com/bOlKyjBx1e

— glassnode (@glassnode) Might 26, 2025

He commented that the sustainability of Bitcoin’s bullish momentum “largely hinges on the broader sentiment throughout monetary markets, significantly the efficiency of US equities.” So long as the US inventory market stays secure, Bitcoin will doubtless preserve its upward trajectory, he argued.

However he famous rising dangers within the bond market. A broader sell-off within the bond market may spill over into crypto.

Nevertheless, Alice Liu, the Head of Analysis at CoinMarketCap, argued that crypto is decupling and shifting independently from conventional markets. Regardless of main macro shockwaves, together with the US credit score downgrade, the weakest Treasury demand in 20 years, and S&P dropping 2% in a day, Bitcoin nonetheless hit an all-time excessive. This reveals “crypto’s rising function instead retailer of worth throughout sovereign debt considerations.”

That mentioned, Lienkha added that Bitcoin is “certainly maturing and regularly gaining recognition as a definite asset class,” however that it nonetheless “has a substantial journey earlier than it may be totally categorized as a hedge.”

Decreased volatility and rising institutional curiosity are encouraging indicators, however the present stability could also be a brief pause and never a everlasting shift. “Precise safe-haven standing requires constant efficiency throughout a number of market cycles and crises, which Bitcoin has but to completely show,” Lienkha mentioned.

Ranges & Occasions to Watch Subsequent

After hitting the all-time excessive of $111,814 final Thursday, BTC noticed a comparatively minor pullback to $110,594. Notably, it’s up from the every day low of $106,815. General, it has elevated by some 6.6% over the previous week. Key resistance ranges stay at $112,000, adopted by $115,000, after which the essential $120,000 degree. Help ranges to control are $107,000 and $100,000. Ought to it comply with additional, it might hit $92,000.

Moreover, ETH “seems to be gearing up for a comeback,” Liu says. The current Pectra improve raised validator caps 64-fold, diminished layer-2 settlement prices, and improved usability. General, the coin is up 42.3% in a month.

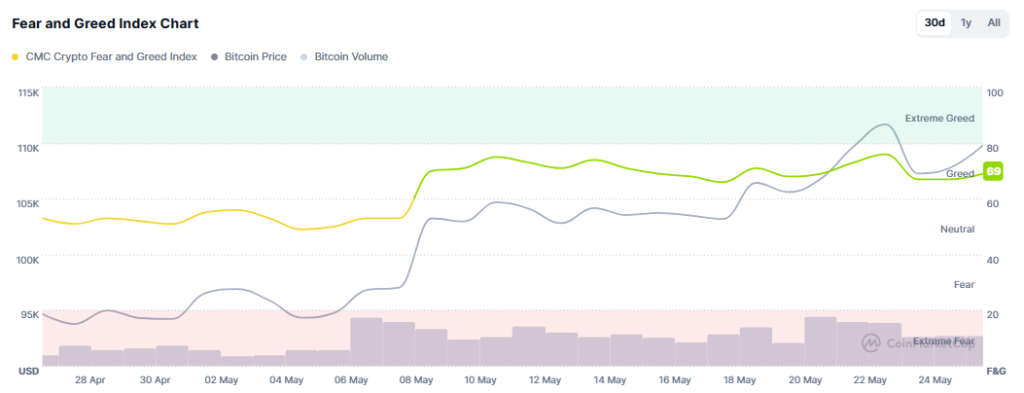

Notably, the Worry and Greed Index has decreased from 76 to 69, suggesting rising bullishness. Buyers are shopping for, anticipating the costs to rally additional.

Furthermore, spot Bitcoin ETFs have seen yet one more day of inflows, at the moment standing at $211.74 million. Spot Ethereum ETFs recorded $58.63 million in web inflows.

In the meantime, lawmakers near Lee Jae Myung, the frontrunner within the South Korean presidential elections, have known as for fast-tracking the rollout of a KRW stablecoin. Min Byoung Dug, a lawmaker for the Democratic Social gathering and the chairman of the social gathering’s Digital Asset Committee, mentioned that “South Korea is an web powerhouse. We have to take the lead in institutionalizing stablecoins earlier than US dollar-based stablecoins change into firmly established. That’s the solely means we will safe a positive place within the world battle for stablecoin hegemony.” Moreover, candidate Lee claimed he would enhance the inventory market and financial restoration.

DPK's Lee Jae-myung urges 'judgment of revolt forces,' pledges insurance policies to spice up inventory markethttps://t.co/NdPe030YSR

— The Korea Occasions (@koreatimescokr) Might 25, 2025

Nevertheless, within the US, main crypto alternate Coinbase is going through a category motion lawsuit as shareholders declare it didn’t disclose a knowledge breach and a regulatory violation. These incidents, they allege, pushed the corporate’s inventory value down. The developments surrounding current lawsuits aimed toward Coinbase might have an effect on the crypto market as effectively.

Fast FAQ

- Why did crypto transfer in opposition to shares at the moment?

The inventory market is down but once more at the moment, whereas crypto continues climbing. The S&P 500 is down 0.67%, the Nasdaq-100 decreased by 0.93%, and the Dow Jones Industrial Common fell 0.61%. Trump’s Friday tariff threats have put the markets on edge once more, says Kate Leaman, chief market analyst at AvaTrade. This fuels buyers’ worries about rising world commerce tensions. Nevertheless, Trump has modified his thoughts but once more on Sunday, so that is prone to replicate on the shares at the moment. Leaman argues that whether or not the tariffs change into actuality or not, “the market is already pricing within the danger.”

- Is that this rally sustainable?

The present developments affecting the market proceed to be favorable, along with the general constructive sentiment. At the moment, the rally appears sustainable. Nevertheless, profit-taking typically comes after a interval of quick beneficial properties, which can result in short-term pullbacks.

The put up Why Is Crypto Up At present? – Might 26, 2025 appeared first on Cryptonews.