Key Takeaways:

- By establishing a devoted Digital Asset Committee, the Democratic Occasion is making crypto regulation a defining problem in South Korea’s upcoming presidential election.

- The committee contains teachers, trade consultants, and trade representatives, exhibiting a uncommon mix of presidency and personal sector enter in shaping nationwide digital asset legal guidelines.

- With ambitions to put the committee below direct presidential management, the initiative may centralize crypto policymaking and speed up South Korea’s push to guide in digital finance.

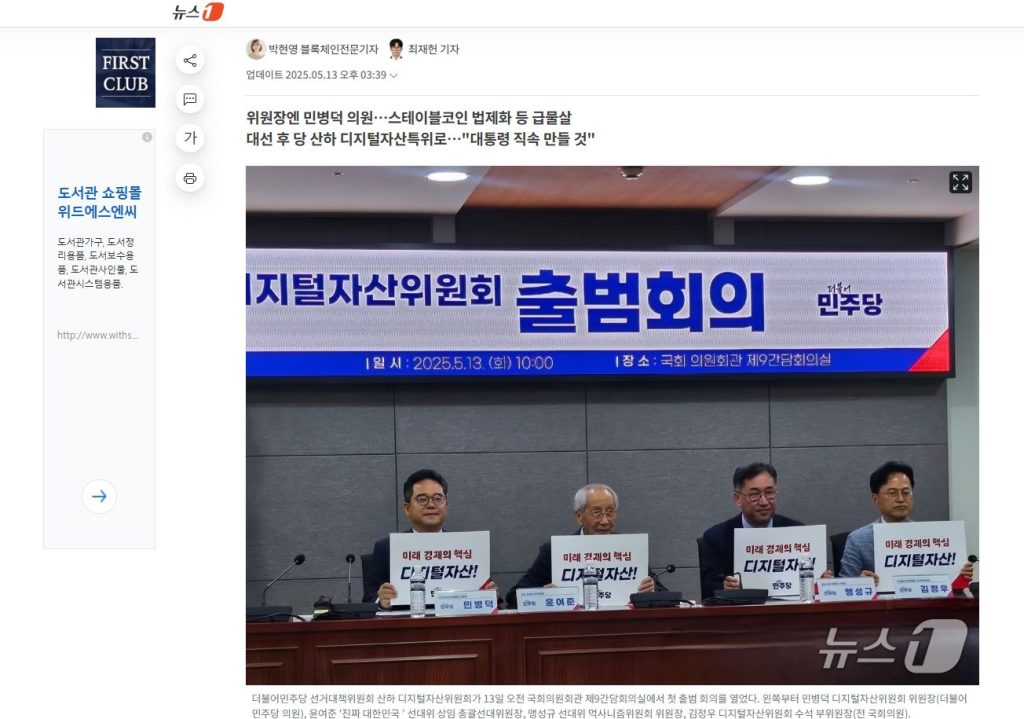

South Korea jolted its presidential race on Might 13 when the Democratic Occasion unveiled a Digital Asset Committee, vowing to drag crypto regulation straight into the following president’s workplace. The committee, shaped below the occasion’s election marketing campaign arm, held its first assembly on Tuesday on the Nationwide Meeting Members’ Corridor in Seoul.

Native information company, News1, reported that the initiative comes as digital belongings emerge as a key problem within the upcoming presidential election.

The committee will play a central position in drafting pledges, driving laws, and constructing frameworks for digital belongings, with early discussions centered on the Primary Digital Asset Act, often called the “Stage 2 Invoice.”

South Korea’s Digital Asset Committee to Draft Crypto Legal guidelines, Push Trade Reform

Rep. Min Byeong-deok leads the committee as chairman. He emphasised the long-term imaginative and prescient, stating,

“The aim is to make the Digital Asset Committee straight below the president in order that it could possibly have experience and implement precise insurance policies.”

The committee is structured round two foremost teams. The Industrial Innovation Development Committee, chaired by Professor Kang Hyung-goo of Hanyang College, will concentrate on boosting South Korea’s management within the world digital financial system.

The Coverage and System Assist Committee, led by Dr. Yoon Min-seop, will work on legal guidelines and regulatory frameworks. As well as, 4 subcommittees will deal with consumer safety, authorized reform, trade progress, and exterior cooperation.

Specialists from exchanges and blockchain corporations will take part, reflecting a mixture of authorities and personal sector involvement.

Stablecoins have been among the many matters raised through the launch assembly. The talk additionally displays rising political curiosity.

Democratic Occasion presidential candidate Lee Jae-myung beforehand supported a won-linked stablecoin, whereas rival candidates raised considerations, citing previous failures just like the Terra-Luna collapse.

“There are discussions about whether or not stablecoins needs to be topic to a licensing system or a reporting system,” Chairman Min famous. “There’s additionally debate over whether or not the Financial institution of Korea or the Monetary Companies Fee ought to lead regulation.”

Financial institution partnerships with crypto exchanges have been additionally mentioned. Presently, one trade usually pairs with one financial institution.

Min acknowledged this as a limitation, saying, “There are clear shortcomings to the one-exchange-one-bank precept.”

Yoon Yeo-jun, a senior official with the marketing campaign, warned that unclear laws are pushing corporations and traders overseas.

“We should resolve these points through the presidential election,” he stated, “and obtain each market improvement and investor safety.”

South Korea’s Central Financial institution Clashes With Lawmakers Over Stablecoin Management Amid Election Warmth

As South Korea’s Democratic Occasion pushes ahead with its new Digital Asset Committee, the Financial institution of Korea (BOK) is drawing a agency line on who ought to oversee the nation’s stablecoin future.

Stablecoins, significantly these pegged to the Korean gained, have quickly change into a serious level of rivalry within the lead-up to the June 3 presidential election.

On Might 12, BOK officers publicly acknowledged that they should have closing authority over the approval and issuance of KRW-based stablecoins, citing dangers to financial coverage and monetary stability.

Koh Kyung-chul, head of the financial institution’s digital finance unit, warned that excluding the central financial institution from early discussions may undermine nationwide financial management. He emphasised that authorized frameworks should be crafted with enter from the BOK to keep away from destabilizing the nation’s monetary ecosystem.

The talk comes as Democratic Occasion candidate Lee Jae-myung requires South Korea to “enter the stablecoin market rapidly,” warning that delays may result in capital flight.

Democratic Occasion (DP) presidential candidate Lee Jae-myung appealed for help throughout a go to to Yeongju, North Gyeongsang, on Sunday, asking, “What did I achieve this mistaken?” https://t.co/YF27ZsVGkG

— The Korea JoongAng Day by day (@JoongAngDaily) Might 4, 2025

In the meantime, Folks Energy Occasion candidate Kim Moon-soo has promised to permit main authorities funds to put money into digital belongings and helps institutional reforms to legitimize crypto.

With over 16 million Koreans engaged in crypto, digital asset coverage has change into a defining problem, reworking the election right into a showdown between central financial institution warning and political ambition.

The submit Is South Korea’s Digital Asset Committee About to Redefine Crypto Regulation? appeared first on Cryptonews.