Key Takeaways:

- Senators Warren and Merkley demand an ethics evaluation of Trump’s $2 billion UAE-linked stablecoin deal.

- UAE funding through Binance raises crimson flags about overseas affect and potential constitutional violations.

- Controversy might delay key crypto laws by means of 2025.

A political and monetary scandal involving a Trump-backed stablecoin and a UAE-linked funding deal has sparked intense scrutiny from lawmakers and nationwide safety consultants.

U.S. Senators Elizabeth Warren and Jeff Merkley name for an instantaneous ethics investigation into what they describe as “a staggering battle of curiosity” surrounding the USD1 stablecoin, World Liberty Monetary (WLF), and a $2 billion overseas funding routed by means of Binance.

Can USD1 Turn out to be a Car for International Affect?

In a letter dated Could 5, the senators addressed to the Workplace of Authorities Ethics, warned that the deal might open “startling” ranges of overseas affect into U.S. governance and should violate constitutional boundaries by financially benefiting President Trump and his internal circle.

Central to the controversy is World Liberty Monetary, a cryptocurrency firm backed by President Trump, his household, and Particular Envoy to the Center East Steve Witkoff.

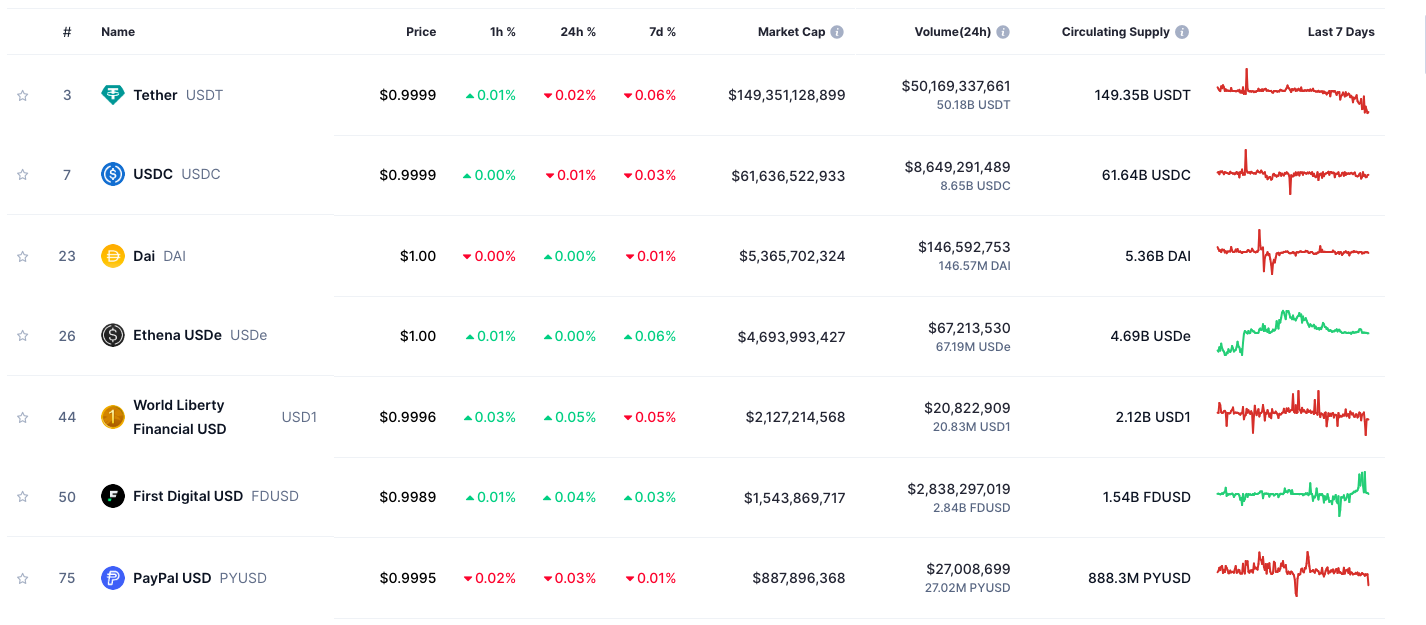

Witkoff’s son, Zach Witkoff, co-founded WLF, which just lately launched the USD1 stablecoin. The USD1 stablecoin is pegged to the U.S. greenback. The digital asset is now the Fifth-largest stablecoin globally, with a market cap exceeding $2 billion.

In line with the senators, a deal is underway for MGX, a UAE state-backed funding agency, to speculate $2 billion into Binance utilizing the USD1 stablecoin.

If finalized, it might generate hundreds of thousands of {dollars} for the Trump and Witkoff households by means of transaction charges, token issuance, and different income streams.

Warren and Merkley argue that this creates a “backdoor for overseas kickbacks and bribes,” exploiting the crypto system’s opacity to counterpoint political elites whereas evading scrutiny.

They famous that WLF wouldn’t solely earn direct revenues from the USD1 transactions however might additionally earn earnings from investing the $2 billion deposit.

Is the UAE Buying and selling Crypto for U.S. Tech Secrets and techniques?

The deal has broader implications. Sheikh Tahnoun Bin Zayed Al Nahyan, chairman of MGX and the UAE’s Nationwide Safety Advisor, is a key determine.

Dubbed the “Spy Sheik,” Tahnoun oversees the UAE’s surveillance and intelligence operations and can also be chairman of G42, a tech agency flagged by U.S. officers for its intensive ties to Chinese language entities. Tahnoun has additionally lobbied the U.S. authorities to calm down export controls on superior AI chips.

His latest assembly with President Trump raises questions on whether or not the crypto deal is a part of a broader quid professional quo because the UAE seeks entry to strategic U.S. applied sciences.

Tonight, within the White Home, I warmly welcomed UAE Nationwide Safety Advisor H.H. Sheikh Tahnoon bin Zayed Al Nahyan to conferences and a dinner with many notable, senior U.S. officers. The night demonstrated the long-standing ties and bonds of friendship between our international locations.…

— Donald J. Trump Posts From His Fact Social (@TrumpDailyPosts) March 19, 2025

Consultants worry loosening AI export controls might empower authoritarian regimes and undermine U.S. management in AI.

Will the Scandal Droop Crypto Laws?

The scandal comes amid renewed debate over stablecoin regulation. Senator Warren, a number one proponent of the GENIUS Act, a invoice looking for to control stablecoins, took to X on Could 4 to criticize the USD1 deal:

“The Trump household stablecoin surged as one of many largest on this planet due to a shady crypto cope with the United Arab Emirates—a overseas authorities that can give them a loopy sum of money.”

The Trump household stablecoin surged to seventh largest on this planet due to a shady crypto cope with the United Arab Emirates—a overseas authorities that can give them a loopy sum of money.

The Senate shouldn’t cross a crypto invoice this week to facilitate this type of corruption. pic.twitter.com/4is9KgpXQb— Elizabeth Warren (@SenWarren) Could 4, 2025

She added that no crypto invoice ought to transfer ahead within the Senate till these moral and nationwide safety issues are addressed.

Whereas some lawmakers push for extra hearings earlier than advancing any laws associated to digital belongings, Home Monetary Providers Committee rating member Maxine Waters introduced plans to dam a Republican-led occasion on Could 6, meant to debate stablecoin coverage and digital belongings.

Nonetheless, some crypto leaders downplay the alarm. For instance, Ryan Selkis, founding father of Messari, argued that stablecoin investments are merely directed into U.S. Treasuries and don’t quantity to private payouts to the Trump household.

Expensive @SenWarren:

1. Investments in stablecoins are investments in US Treasuries, not presents to the Trump household.

2. World Liberty’s stablecoin is <1% of the stablecoin market.

3. Your corruption with SBF and the 2023 ChokePoint 2.0 warrant jail time.

Dems will now be punished. https://t.co/WWRUjwFMo5 pic.twitter.com/fxwUhqrXD2— Ryan Selkis (d/acc)

(@twobitidiot) Could 6, 2025

He additionally famous that USD1 nonetheless accounts for lower than 1% of the whole stablecoin market.

Ceaselessly Requested Questions (FAQs)

Why would Binance danger involvement with Trump-linked stablecoins?

Following its $4.3 billion settlement with U.S. regulators and the resignation of its founder, Changpeng Zhao, who later served a jail time period for cash laundering, Binance seeks Center Jap progress however faces new scrutiny over the UAE deal. The trade is the recipient of the $2 billion funding, which will likely be executed utilizing USD1.

How does the USD1 stablecoin transaction examine to conventional banking?

Eric Trump has criticized the inefficiency of conventional banking techniques, indicating that stablecoin transactions like USD1 can settle in minutes, whereas worldwide financial institution transfers through SWIFT can take over a day.

The submit U.S. Senate Ethics Uproar: Will Trump’s $2B UAE Stablecoin Stall Crypto Payments? appeared first on Cryptonews.