Crypto adoption is accelerating worldwide, and conventional monetary establishments are racing to satisfy rising shopper demand. On April 30, 2025, Kraken, a globally acknowledged crypto change with over a decade of trade expertise, launched Kraken Embed. It’s a brand new Crypto-as-a-Service (CaaS) resolution particularly designed to assist banks, neobanks, and FinTechs supply seamless crypto buying and selling to their prospects.

By decreasing infrastructure overhead, Kraken Embed for banks and different monetary platforms might be a game-changer in bringing cryptocurrencies to the mainstream.

Understanding Kraken Embed

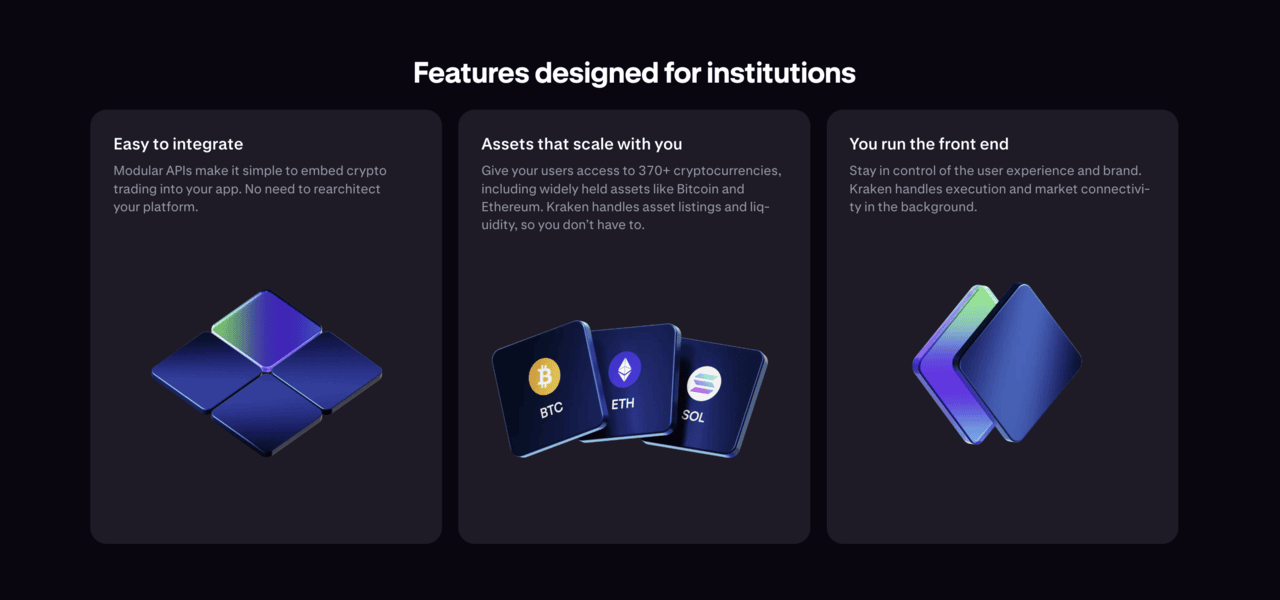

Kraken Embed is a plug-and-play, regulated crypto buying and selling resolution that any monetary establishment can combine into their very own current platform. As a substitute of spending tens of millions of {dollars} and numerous hours constructing their very own in-house exchanges or participating with advanced authorized frameworks, banks and FinTechs can faucet into Kraken crypto-as-a-service and embed direct crypto buying and selling for his or her consumer base.

In reality, with entry to over 370 digital property, customers can commerce well-liked cryptos like Bitcoin and Ethereum alongside rising altcoins.

Banks can launch this service in a matter of weeks by way of modular APIs, which is able to deal with the principle work required for liquidity, custody, and settlement. As a result of Kraken has spent years engaged on its back-end techniques, Embed CaaS resolution companions can get pleasure from the identical reliability, safety, and compliance that Kraken is understood for.

bunq Is the First Financial institution to Undertake Kraken Embed

One of many earliest adopters to indicate Kraken Embed’s potential is bunq, a number one European neobank. This Kraken bunq partnership built-in neobank crypto buying and selling straight into bunq’s cellular app, delivering an easy-to-use interface that also advantages from Kraken’s deep experience and backend infrastructure.

Bunq’s rollout exhibits Kraken’s dedication to FinTech crypto options, particularly in areas the place regulatory readability (comparable to MiCA regulation in Europe) creates the best way for mainstream crypto adoption.

The bunq case examine additionally highlights Kraken’s skill to supply crypto entry for banks and FinTech gamers globally.

Why Banks and FinTechs Are Selecting Kraken Embed

Easy Crypto Integration

Constructing a crypto change from scratch is difficult. It requires specialised expertise, safe custody options, real-time buying and selling engines, and 24/7 buyer help. With Kraken Embed, banks and fintechs can get a ready-made resolution. Banks can retain their front-end expertise whereas Kraken will handle duties like order matching, liquidity pooling, and value feeds.

On the spot Regulatory Compliance

Crypto regulation stays a significant concern for conventional monetary establishments. The Embed CaaS resolution totally aligns with Kraken’s complete licensing and compliance requirements. Quite than buying separate authorizations, companions can basically plug into Kraken’s institutional providing. It complies with related jurisdictions’ laws, together with the rising European framework underneath Markets in Crypto-Belongings (MiCA).

Entry Kraken’s Confirmed Market Liquidity and Experience

By tapping into Kraken’s order books, accomplice establishments can supply their customers constant commerce execution and aggressive spreads. Having run one of many world’s most liquid crypto exchanges, Kraken additionally brings skilled market information to make sure that banking purchasers can execute trades easily, even throughout high-volatility moments.

How MiCA Rules Are Accelerating Crypto Integration

In Europe, MiCA regulation is bringing concord to the best way digital property are issued and traded. MiCA goals to make sure investor safety and steady market behaviour, offering the wanted security for conventional monetary establishments to enter the crypto area. As this regulatory framework begins to take form, Kraken Embed is uniquely positioned because the end-to-end crypto buying and selling resolution that matches the requirements that crypto regulation in Europe calls for.

In the meantime, world sentiment round crypto can be shifting. International locations just like the U.S. and the UK are exhibiting renewed curiosity in authorized frameworks that encourage progressive FinTech options. With the backdrop of those laws, conventional banks are actually eager to enter the digital asset area however typically lack the inner assets to take action successfully. That’s precisely the hole Kraken Embed goals to fill.

Rising Institutional Crypto Adoption

Stories from PYMNTS present that main banks (comparable to ING, U.S. Financial institution, and members of the Lynq Community) are exploring methods to combine crypto companies into their current monetary fashions.

Whether or not it’s stablecoins, blockchain-based settlement techniques, or direct crypto buying and selling, establishments are at present seeing enormous alternatives in digital property. Kraken desires to offer a streamlined path to this market, letting them capitalize on these alternatives with out constructing their very own platforms from the bottom up.

Insights from Kraken’s Management

Addressing the significance of Kraken’s new providing, Brett McLain, head of funds and blockchain at Kraken, shared:

“Via Embed, Kraken is extending its deep experience to establishments searching for a dependable, compliant and frictionless entrypoint into crypto.”

It’s an announcement that speaks to why they’ve constructed Kraken Embed for banks: to make it simpler and extra handy for any monetary establishment to assist their purchasers be part of the crypto ecosystem.

Conclusion: How Kraken Embed Is Shaping the Way forward for Crypto for Banks

The launch of Kraken Embed is a major milestone within the continued growth of FinTech crypto options. The plug-and-play design offers banks and neobanks a direct line into Kraken infrastructure—constructing a bridge from current finance to the rising world. This Velocity-to-market strategy permits new and current platforms so as to add a crypto tab just about in a single day, with the safety of embedded compliance, deep liquidity and a trusted model.

With MiCA regulation Europe and wider world crypto coverage frameworks gaining momentum, consideration will flip more and more to suppliers able to providing institutional-grade belief and ease of entry.

Go to Kraken

FAQs

What does Kraken Embed do?

Kraken Embed is a Crypto-as-a-Service platform that enables banks, FinTechs and different monetary establishments to combine safe crypto buying and selling into their current apps or web sites.

Why is Embed essential for monetary establishments?

By utilizing Kraken Embed, establishments keep away from the trouble of constructing a crypto change from the bottom up, whereas additionally profiting from Kraken’s liquidity pool and regulatory approvals.

Who’s already utilizing Kraken Embed?

The primary publicly introduced accomplice is bunq, a number one European neobank recognized for its progressive strategy to digital banking. Via its integration of Kraken Embed, bunq is providing its customers seamless neobank crypto buying and selling.

The publish Kraken’s ‘Embed’ Opens New Crypto Alternatives for Banks and FinTechs appeared first on Cryptonews.