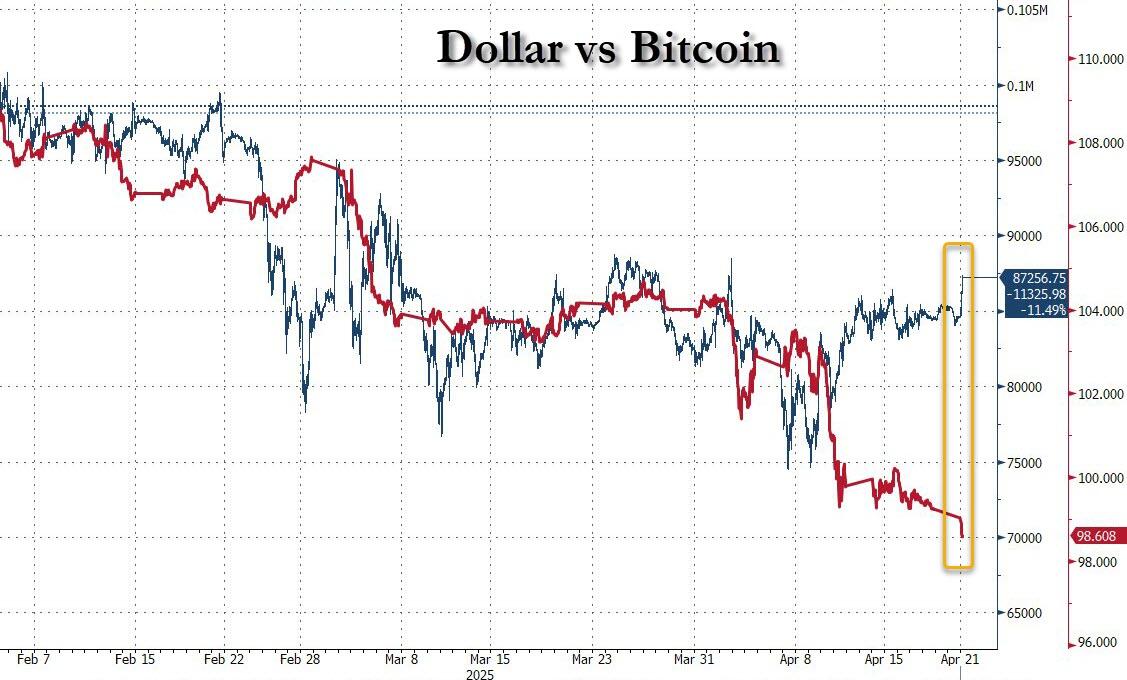

Bitcoin surged above $87,000 throughout early Asia buying and selling on Monday, extending beneficial properties as broader markets reopened after buying and selling flat all through the Easter vacation closure.

The digital asset’s transfer adopted three classes of tight consolidation, coinciding with broad greenback weak spot and a record-setting rally in gold.

BTC/USD climbed from roughly $84,450 to an intraday excessive close to $87,650 in below three hours, breaking above a multi-day falling wedge sample. In response to TradingView knowledge, Bitcoin was buying and selling at practically $87,640 on the time of publication.

The breakout unfolded throughout low-liquidity circumstances in early Asia hours, with the greenback index (DXY) falling to its lowest degree since 2021.

This coincided with rising hypothesis across the potential removing of Federal Reserve Chair Jerome Powell.

As ZeroHedge reported, feedback made Friday by Nationwide Financial Council Director Kevin Hassett, who acknowledged that “the president and his group will proceed to check” choices relating to Powell’s place, had been cited by merchants as a catalyst for the greenback’s decline.

Greenback weak spot triggers haven flows.

The greenback’s fast decline, occurring whereas a number of world markets remained closed, pushed demand towards conventional and digital shops of worth.

Gold costs surged to an all-time excessive of $3,391.62 throughout the identical session, registering a 2.4% achieve. Per Reuters, the transfer marked the metallic’s most substantial single-day rally in months.

Digital gold within the type of Bitcoin rose in tandem, diverging from latest habits, when each belongings had moved inversely to the 10-year U.S. Treasury word. Notably, bond costs fell Monday; the US10 and CN10 plots on the chart characterize bond costs, not yields, implying a concurrent rise in long-dated yields.

The Kobeissi Letter reported,

“The narrative in each Gold and Bitcoin is aligning for the primary time in years:

Gold and Bitcoin are telling us {that a} weaker US Greenback and extra uncertainty are on the best way.”

The mixture of a falling greenback, climbing yields, and hovering gold presents a state of affairs the place Bitcoin is being repriced in gentle of perceived instability in conventional monetary devices.

As ZeroHedge framed it, the alignment of gold and Bitcoin power throughout a interval of fiat stress could replicate “a regime shift” the place digital belongings are more and more handled as financial hedges.

Broader market divergence

Fairness markets opened weaker regardless of haven power. The S&P 500 futures fell 1.54% in Monday’s early session, erasing late-week beneficial properties. Oil markets additionally declined, with WTI crude down greater than 3%, buying and selling close to $62.83 on the session low.

This divergence between conventional danger belongings and different shops of worth mirrors circumstances noticed throughout different intervals of financial uncertainty.

Gold and Bitcoin rising collectively whereas bond costs fall and fairness indices slip suggests positioning away from rate-sensitive belongings and into devices perceived as politically insulated.

Per ZeroHedge, the greenback’s descent could not stabilize shortly. If central banks just like the Financial institution of Japan and European Central Financial institution reply with easing measures to counter their very own forex power, additional greenback strain may ensue.

In such an surroundings, Bitcoin could proceed to decouple from rate-based devices and observe extra intently with bodily commodities like gold.

Structural implications

The correlation breakdown between Bitcoin and conventional macro proxies raises questions round portfolio allocation and asset classification.

With bond costs and equities weakening whereas gold and Bitcoin outperform, merchants could start to reevaluate how digital belongings are categorized in cross-asset frameworks.

This transfer follows weeks of gradual decorrelation between Bitcoin and the DXY, as noticed via 30-day rolling correlation metrics.

Ought to this proceed, Bitcoin will lose its notion as a tech-aligned danger asset and change into extra of a financial hedge with traits just like commodities.

The political dimension additionally looms massive. Whereas earlier episodes of Trump-Fed tensions triggered short-term volatility, the present episode introduces direct discourse round potential Federal Reserve management adjustments. This will likely affect market pricing of future fee selections and broader financial coverage expectations, each of which may spill into crypto markets.

As buying and selling resumes in full throughout areas, Bitcoin’s habits close to the $88,400 resistance band could provide additional readability. Sustained power above this degree may appeal to systematic flows and set off algorithmic shopping for. On the identical time, failure to carry above the breakout zone could expose the asset to reversion towards mid-range ranges.

For now, the asset’s efficiency in a blended macro surroundings, mixed with decoupling from equities and stuck revenue, positions it on the middle of post-holiday buying and selling narratives.

The put up Bitcoin rallies above $87k whereas greenback weakens on Powell hypothesis after lengthy weekend appeared first on CryptoSlate.