Main publicly traded Bitcoin miner MARA Holdings is exploring the sale of as much as $2 billion in inventory providing to buy extra BTC.

On 28 March, the miner has submitted a present report (aka Kind 8-Okay) and a prospectus with the US Securities and Trade Fee (SEC). It offered particulars of the potential sale and supposed utilization of the funds from the gross sales.

The Second-Largest Bitcoin Holder

In keeping with the paperwork, Bitcoin miner MARA has entered into an at-the-market (ATM) providing settlement with a lot of gross sales brokers to supply as much as $2 billion of shares of its frequent inventory “on occasion.” The worth is $0.0001 per share.

An ATM providing is a follow-on providing of securities, which publicly traded corporations use to boost capital over a sure time frame. The issuer sells newly issued shares into the buying and selling market by a delegated gross sales agent at dominant market costs.

Moreover, the prospectus names Barclays Capital, BMO Capital Markets, BTIG, Cantor Fitzgerald & Co., Guggenheim Securities, H.C. Wainwright & Co., and Mizuho Securities USA because the gross sales brokers.

The gross sales brokers, ought to there be any gross sales, will probably be compensated with as much as 3% of the gross proceeds per share bought, the corporate says.

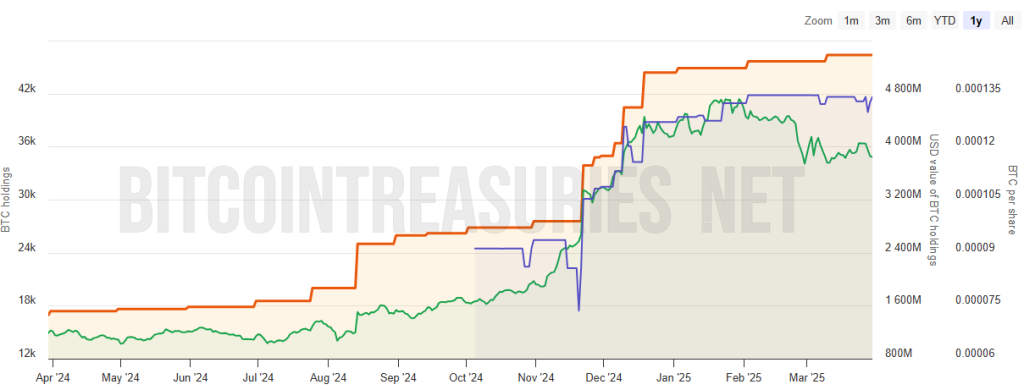

MARA at present holds 46,374 BTC ($3.8 billion). In keeping with BitcoinTreasuries, it’s the second-largest holder, after Microstrategy.

MARA Holdings, Inc. — Bitcoin Holdings Over Time:

“We at present intend to make use of the web proceeds from this providing for basic company functions, together with the acquisition of bitcoin and for working capital,” the prospectus reads.

Furthermore, the corporate would use the funds to purchase extra Bitcoin mining servers. The above-mentioned basic company functions embrace strategic acquisitions, joint ventures, enlargement of current belongings, and compensation of debt and different excellent obligations, MARA says.

In the meantime, the quantities and timing of the usage of the sale proceeds will rely on many components, it argues, corresponding to from tech advances, progress of analysis and growth efforts, and the aggressive surroundings for the merchandise. The administration may have “broad discretion within the timing and software of those proceeds.”

You may also like Bitcoin Miner MARA Income Grows in This fall 2024 Resulting from Rise in Bitcoin Costs: Report

Bitcoin Miner Lowest Transaction Charges Share in Three Years’

Bitcoin’s transaction charges have seen “one other notable decline” in March, in keeping with the Miner Weekly report by BlocksBridge Consulting. They make up only one.25% of the full block rewards, stated the report, citing TheMinerMag.

Notably, to this point in 2025, these charges have constantly accounted for lower than 2% of the month-to-month block rewards.

“This marks the bottom share of transaction charges in three years, since April 2022, signaling a major shift within the community’s dynamics,” the report states.

For instance, the full transaction charges in March 2025 up till the time of the report have totaled 155 BTC – not but half of the 361 BTC seen three years in the past.

In the meantime, because the hashrate is recovering, the subsequent issue adjustment may even see an increase. Per the researchers, extra miners are competing for a similar block subsidies. On the identical time, there are fewer charges to be shared.

Due to this fact, miners with larger operational prices might expertise extra pressure in profitability with the rising issue.

“With no vital uptick in Bitcoin’s market worth or a revival in transaction charges, these miners could quickly face an unmanageable state of affairs: they might not be capable to compete,” the report argues.

We’re prone to see additional consolidation throughout the mining trade as bigger gamers soak up extra market share.

You may also like Canaan Reveals New Bitcoin Mining Machine for Residence Use

The put up Bitcoin Miner MARA Seems to Promote $2 Billion in Shares to Develop BTC Stash, Purchase Extra Servers appeared first on Cryptonews.