Okay Financial institution, a number one South Korean neobank, could possibly be thwarted in its newest try and launch an preliminary public providing (IPO) by its “dependence” on its associate, the crypto change big Upbit.

Per Busan Ilbo, Okay Financial institution will make a 3rd try and go public following a board assembly held on March 12.

Okay Financial institution IPO: Will Third Time Show a Attraction for Neobank?

The financial institution first tried to launch an IPO in February 2023, earlier than making an attempt once more in October 2024.

Seoul shares open larger on in a single day US positive aspects#Kospi #Kosdaq #shares #updateshttps://t.co/LnKTgL1PCF

— The Korea Herald 코리아헤럴드 (@TheKoreaHerald) March 13, 2025

Following the second try, some South Korean media retailers appeared to level the finger on the Upbit deal, claiming that Okay Financial institution’s over-reliance on Upbit enterprise was “in charge.”

Okay Financial institution was compelled to shelve its bids on each cases. Nonetheless, the financial institution dedicated to creating a 3rd try this 12 months, because the expiry date for its regulatory approval approaches.

Nonetheless, the media outlet quoted “market sources” as predicting that Okay Financial institution will battle to get its IPO over the road as soon as once more.

They opined that Okay Financial institution’s “power dependence” on its banking take care of Upbit might show a key issue.

Upbit: A ‘Monopoly?’

Upbit is South Korea’s greatest crypto change by market share and buying and selling quantity. Through the coronavirus pandemic, the Okay Financial institution-Upbit partnership proved enormously profitable.

South Korean legislation requires all fiat-trading crypto exchanges to strike offers with home banks. The latter present change clients with social safety number-verified fiat on/off ramps.

Through the pandemic, the events had been the one banking-exchange duo capable of provide new shoppers the flexibility to crypto wallet-linked financial institution accounts on-line.

On the time, different banks nonetheless required new clients to open in-person accounts in high-street branches.

Since then, different banks have adopted go well with, and have begun permitting their clients to open crypto exchange-linked financial institution accounts on-line.

However Upbit’s dominance has proven no signal of waning, with some lawmakers claiming that the change has change into a de facto “monopoly.”

Lengthy-term Profitability

The media outlet referred to as Okay Financial institution’s “dependence” on Upbit “extreme,” including that this was “one of many causes” behind “poor demand forecasts.” The outlet wrote:

“The truth that a good portion of Okay Financial institution’s income rely closely on Upbit raises questions on its capability to maintain its profitability in the long run. Upbit accounts for about 20% of Okay Financial institution’s deposit stability. There are issues that it might expertise a ‘financial institution run’ if there’s important volatility within the crypto market.”

The media outlet added that Upbit’s latest fiat deposit rate of interest rise might even have a “damaging impression on Okay Financial institution’s profitability.”

Final month, one other media outlet reported that a number of “conventional” banks are monitoring the state of affairs at Upbit and Okay Financial institution.

South Korean equipment maker DN Options Co. is looking for $800 million to $1 billion in an preliminary public providing in Seoul, folks aware of the matter stated, in what could possibly be the nation’s largest such deal this 12 months. https://t.co/3kwKCpmaBW

— Bloomberg (@enterprise) March 13, 2025

Conventional Banks Circling

The duo’s present deal is because of expire in October, with a number of monetary suppliers at the moment “weighing their choices.”

If that’s the case, they are going to doubtless be buoyed by latest occasions at Bithumb, Upbit’s closest rival. The change lately ditched its partnership take care of NongHyup Financial institution in favor of an settlement with Kookmin, South Korea’s largest banking participant.

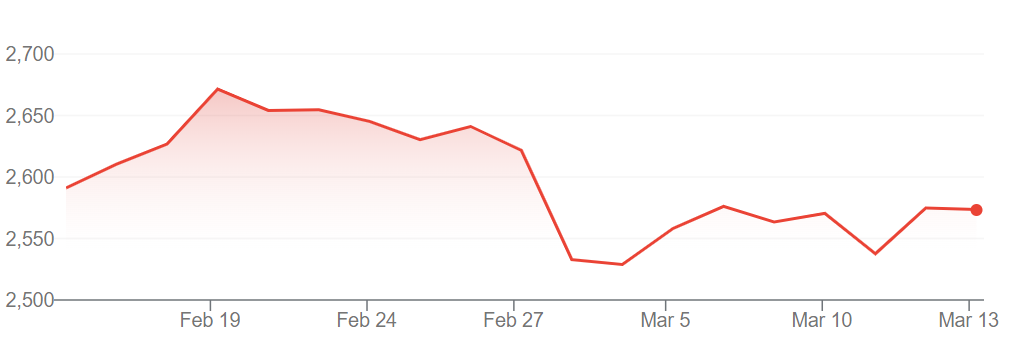

The media outlet wrote that different components might additionally hamper Okay Financial institution’s IPO bid. These embrace “sluggish inventory market costs” attributable to “inside and exterior uncertainties.”

The S&P 500 and the Nasdaq closed in constructive territory, the latter having fun with a muscular increase from tech and tech-adjacent momentum shares. Intel shares soared in prolonged buying and selling after the corporate named Lip-Bu Tan as its new CEO https://t.co/fPw4luPaFa pic.twitter.com/07BIkCpNZj

— Reuters (@Reuters) March 13, 2025

Okay Financial institution beforehand aimed for a 4 trillion received ($ 2.75 billion) valuation in its most up-to-date IPO bid. “Market insiders” had been quoted as claiming the valuation “ought to be lowered by at the very least 1 trillion received ($687 million).”

This might show a problem, Busan Ilbo wrote. It defined that sources declare its monetary traders are more likely to object if it requests a decrease valuation.

The submit ‘Upbit Dependence May Derail New Okay Financial institution IPO Bid’ – Report appeared first on Cryptonews.