Bitcoin fell to a one-month low of $93,000, with analysts from CryptoQuant warning {that a} additional decline towards $86,000 might happen until demand progress and liquidity situations present indicators of restoration.

Bitcoin Demand Weakens, Rising Worth Correction Dangers

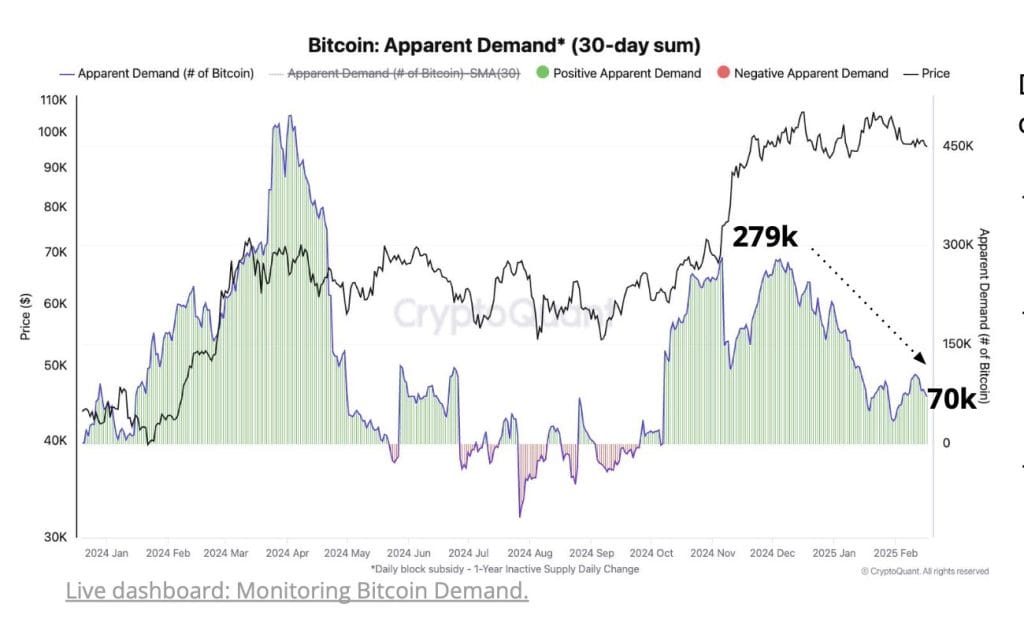

Bitcoin demand progress has weakened considerably. After a surge in November-December 2024, partly fueled by U.S. election outcomes, demand has sharply declined from 279,000 on December 4, 2024 to simply 70,000 as we speak.

This decline in demand is additional mirrored in ETF exercise. Bitcoin ETF internet inflows, which peaked at 18,000 BTC, have reversed to a internet outflow of 1,000 BTC, signaling a pullback in investor confidence.

Demand for Bitcoin from Spot ETFs is lower than half of what it was at this level final yr.

Web inflows

2025: 41K Bitcoin

2024: 100K Bitcoin

ETFs are merely not shopping for as a lot up to now this yr. pic.twitter.com/IjDGSRrvn9— Julio Moreno (@jjcmoreno) February 19, 2025

CryptoQuant’s Inter-exchange Stream Pulse highlights declining spot Bitcoin demand within the U.S., as fewer BTC are shifting from different exchanges to Coinbase.

The metric just lately fell under its 90-day shifting common, suggesting lowered shopping for curiosity amongst each institutional and retail buyers.

This pattern raises the chance of an prolonged value correction.

CryptoQuant Knowledge Exhibits Weak Liquidity Inflows from Stablecoins

Regardless of stablecoins reaching a file $200 billion in whole market capitalization, their enlargement fee has decelerated sharply.

The 60-day change in USDT’s market cap has dropped 92%, declining from $20.4 billion on December 16 to simply $1.5 billion as we speak.

A restoration in stablecoin liquidity might play a key function in supporting Bitcoin’s value stability. And not using a sustained inflow of liquidity, Bitcoin could battle to regain upward momentum.

Along with weak demand and slowing liquidity, Bitcoin community exercise has fallen to its lowest degree in a yr, declining 17% since peaking in November 2024.

CryptoQuant’s Bitcoin Community Exercise Index has slipped under its 365-day shifting common for the primary time since July 2021, when China banned Bitcoin mining.

This pattern suggests lowered on-chain demand, reinforcing bearish situations.

With demand weakening, liquidity inflows slowing, and community exercise declining, Bitcoin stays weak to additional value corrections until a shift in market situations reverses these traits.

Investing in Unsure Occasions

As Bitcoin faces strain on a number of fronts, the dialogue invitations readers to embrace reflective decision-making.

The mixture of subdued demand, tepid liquidity, and quiet community exercise provides a possibility to rethink one’s method to digital investments.

It raises a vital query: how ought to one handle publicity in a market characterised by steady flux?

Relatively than chasing short-term optimism, this era requires a disciplined appraisal of threat and potential.

Each bit of market knowledge contributes to a broader narrative, urging buyers to craft methods which are each measured and knowledgeable.

The submit Worth Correction on the Playing cards: Bitcoin Demand and Liquidity Stay Weak: CryptoQuant appeared first on Cryptonews.