Coinbase exceeded revenue forecasts for This autumn on Thursday as heightened buying and selling in Bitcoin and different digital tokens adopted the US election.

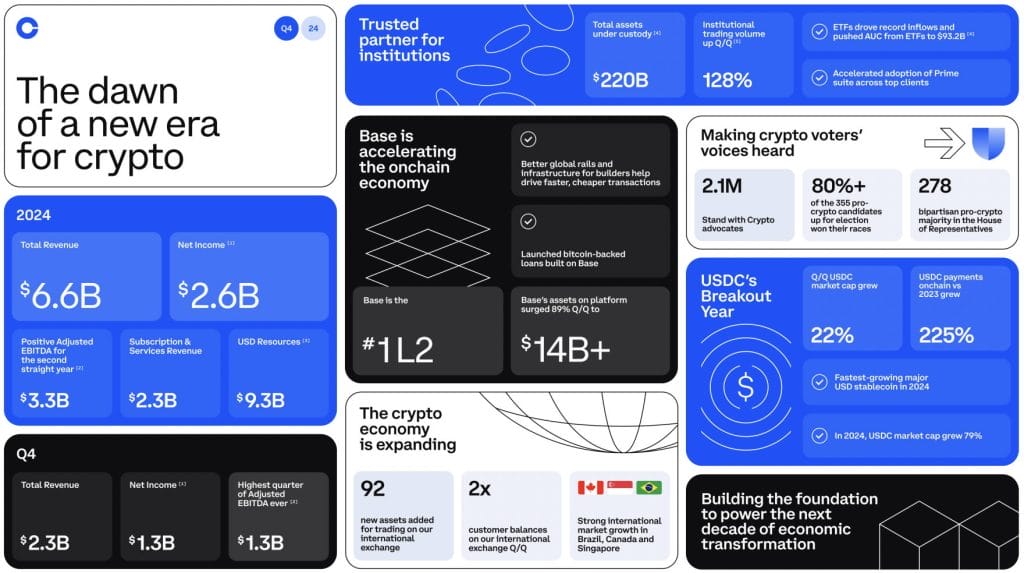

The operator of the most important US crypto buying and selling platform reported a web revenue of $1.3b or $4.68 per share—up considerably from the $273m, or $1.04 per share, recorded in the identical quarter final yr.

Donald Trump has pledged to show the US into the “crypto capital of the planet.” In pursuit of this imaginative and prescient, he has stuffed key authorities roles with digital foreign money advocates.

As an example, he appointed Paul Atkins—a widely known supporter of cryptocurrencies—to guide the Securities and Alternate Fee.

This transfer sharply contrasts with former SEC Chair Gary Gensler’s “Wild West” depiction of the crypto business. Furthermore, this shift suggests a extra crypto-friendly regulatory stance, probably paving the best way for elevated blockchain innovation and funding within the US.

$COIN absolute blowout!

EPS: $4.68 vs $2.11 exp.

REV: $2.27B vs $1.84B exp.

Income: +138% YoY

Web Revenue: +300% YoY

Transaction Income: +194% YoY

Subscription Companies: +71% YoY

Buying and selling Quantity: +185% YoY

Month-to-month Transacting Customers: +24% YoY pic.twitter.com/XA9AlSUhHr— Geiger Capital (@Geiger_Capital) February 13, 2025

“We’re actually getting into a golden age for crypto right here,” CEO Brian Armstrong through the earnings name. “The chance in entrance of us is unprecedented to replace the monetary system and enhance financial freedom all over the world.”

“The regulatory overhang is lifting. Governments are leaning in, and we’re shaping the subsequent chapter of crypto from buying and selling to funds to client apps and past. 2025 goes to be an excellent yr,” he added.

Coinbase Posts $2.3B Quarterly Income with Buying and selling Nonetheless Dominating

Coinbase reported quarterly income of $2.3b, marking a considerable 140% leap from the $953.8m recorded throughout the identical interval final yr. In the meantime, transaction income surged to $1.56b—greater than double the earlier determine and exceeding analysts’ predictions of $1.29b.

Moreover, the corporate generated $750m in buying and selling income as much as Feb. 11 and now expects buying and selling income to characterize a mid- to high-teens proportion of web income this quarter.

Whereas the alternate is working to diversify its income streams past buying and selling, buying and selling nonetheless comprised 68.5% of its complete income in This autumn, primarily fueled by retail dealer exercise.

Supply: Coinbase

New Asset Launches and Platform Upgrades Drive 24% MTU Improve

In the course of the quarter, Coinbase onboarded 13 new property, together with trending meme cash like PEPE and WIF, whereas additionally specializing in enhancing each the buying and selling expertise and platform stability. Consequently, Month-to-month Transacting Customers (MTUs) surged by almost 24% to succeed in 9.7m.

Notably, nearly half of Coinbase’s buying and selling clients in This autumn have been both newcomers or returning customers after a year-long absence.

On a broader scale, the corporate’s subscription and companies income for 2024 climbed to $2.3b—a 64% year-over-year enhance and roughly 4.5 instances the extent seen through the 2021 bull market.

This progress was pushed primarily by blockchain rewards, stablecoin transactions and the Coinbase One subscription service. Particularly, within the fourth quarter, subscription and companies income rose to $641m, marking a 15% enhance from the earlier quarter.

USDC Emerged As Quickest-Rising Stablecoin

Coinbase’s stablecoin income declined by 9% quarter-over-quarter to $226 million in This autumn, but it climbed 31% year-over-year to succeed in $910m for the total yr.

In 2024, USDC emerged because the fastest-growing main stablecoin. Furthermore, the fourth quarter noticed income beneficial properties pushed by a notable enhance in each the common market cap of USDC and its presence in our product choices. Nonetheless, these beneficial properties have been partially offset by decrease efficient rates of interest and new entrants within the USDC ecosystem throughout This autumn.

In the course of the earnings name, Brian Armstrong reiterated that the corporate’s “stretch aim is to make USDC the primary stablecoin.”

The put up Coinbase This autumn Income Soars Over 140% as Publish-Election Crypto Rally Propels Costs appeared first on Cryptonews.