We’re now one week into Donald Trump’s presidency — the very begin of what’s going to be a consequential 4 years for the crypto business.

The choices made by his administration will form this sector for many years, straight have an effect on thousands and thousands of buyers worldwide, and decide whether or not different main economies enact pro-Bitcoin insurance policies of their very own.

With Silk Street founder Ross Ulbricht pardoned, and a crypto-focused government order now signed, Trump has already come good on among the guarantees made throughout the marketing campaign.

However as Bitcoin’s bull run exhibits indicators of stalling, many unanswered questions stay — as we’re about to search out out.

1. Will a Strategic Bitcoin Reserve Occur?

To an adoring crowd on the Bitcoin 2024 convention, Trump had a easy message: if elected, his administration would “hold 100% of all of the Bitcoin the U.S. authorities at the moment holds or acquires into the longer term.”

Make no mistake, this was a huge promise that might put BTC proper on the coronary heart of America’s economic system, leaving different nations within the G20 with little alternative however to do the identical.

But there was disappointment when final week’s government order said that the White Home would solely now “consider” this coverage, watering down this pledge — and making a danger it’ll by no means occur in any respect.

Polymarket’s odds point out that the prognosis isn’t good. Simply 16% of bettors now assume this stockpile is probably going in Trump’s first 100 days, whereas the prospects of a reserve rising this 12 months are successfully 50/50.

The reluctance to even convert BTC seized from criminals right into a stockpile signifies there could also be authorized complexities or a change of focus, with AI dominating presidential priorities up to now. And it doesn’t bode nicely for Senator Cynthia Lummis’s ambition of buying a million Bitcoin over a five-year interval.

2. Are Banks Going to Undertake Bitcoin?

The Securities and Alternate Fee scrapping SAB 121, which stopped banks from taking custody of Bitcoin on behalf of purchasers, is a big deal.

With this guardrail now torn down, it’ll be fascinating to see how monetary corporations react and adapt — and whether or not conventional establishments might find yourself turning into a rival to long-running crypto exchanges… or possibly even acquisition targets.

3. Will Stablecoins Take Middle Stage?

Trump’s government order formally sounded the demise knell for a U.S. central financial institution digital forex, with skeptics claiming it could possibly be used to spy on customers and management their spending.

However it additionally opened the door for the likes of USDC and USDT to serve as a substitute, with actions “to advertise the event and development of lawful and legit dollar-backed stablecoins worldwide.”

There are hopes such digital property might assert the greenback’s dominance within the international economic system, but this received’t be with out challenges.

Particular laws on stablecoins is but to make its means by means of Congress — and cautious scrutiny should be paid to the reserves used to again them.

4. Will Trump’s Cryptocurrency Be Investigated?

It’s been a dramatic week for $TRUMP, the meme coin that was launched mere days earlier than the inauguration.

Recent from dropping 50% of its worth over the previous seven days — and now buying and selling 65% off all-time highs — some Democrats are demanding an investigation be held into the “unprecedented considerations” it raises.

Trump’s arch-rival Elizabeth Warren (who he disparagingly refers to as “Pocahontas”) has urged the SEC and CFTC to look into the circumstances surrounding this token’s debut — citing threats together with “client ripoffs, corruption and overseas affect, and conflicts of curiosity.”

Given each businesses are actually being stacked with pro-crypto commissioners — and a clause in $TRUMP’s phrases and circumstances features a waiver in opposition to class actions — it’s unlikely this backlash will find yourself troubling the president all that a lot.

5. Will Altcoin-Targeted ETFs Launch?

Alternate-traded funds primarily based on the spot costs of Bitcoin and Ether proved vastly widespread in 2024, and had been accredited regardless of reticence from the Securities and Alternate Fee.

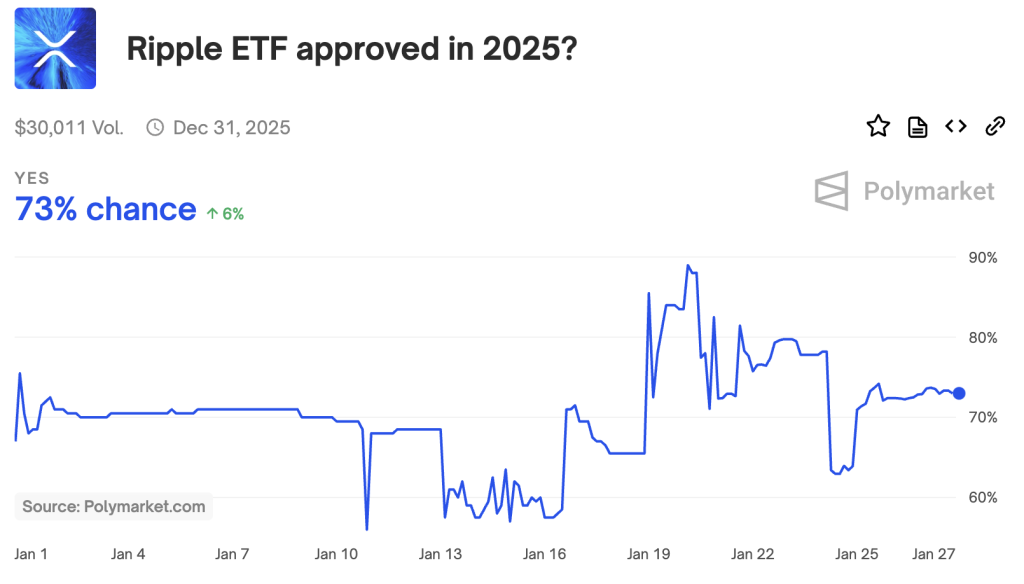

However now, there’s a widespread expectation that asset administration corporations can be given permission to launch merchandise monitoring smaller cryptocurrencies together with XRP, Solana… and even $TRUMP.

It’ll be fascinating to see whether or not such they find yourself attracting curiosity amongst establishments, particularly contemplating inflows into ETH ETFs have confirmed to be fairly underwhelming up to now.

Whereas the overall web property held by 12 Bitcoin spot ETFs now stands at $123 billion, the 9 specializing in Ether lag behind on $12 billion.

6. Will Elon Musk Flip to Blockchain?

Stories not too long ago steered that the Division of Authorities Effectivity (often known as DOGE for brief) is exploring whether or not federal spending could possibly be tracked utilizing blockchain know-how.

Such a transfer has the potential to supercharge transparency, streamline funds, and even change the best way authorities buildings are managed.

However an even bigger query is that this: which blockchain undertaking could be seen as being as much as the duty? Would its native token find yourself surging in worth? And will this trigger safety considerations to emerge?

24h7d30d1yAll time

7. Will ‘Trumponomics’ Derail the Bull Run?

Trump’s vow to impose tariffs on overseas items is only one financial coverage that would ship shockwaves by means of the markets, exacerbating inflation whereas slowing development.

The president has already urged the Federal Reserve to begin reducing rates of interest — claiming he has a greater understanding of financial coverage than this central financial institution does.

All of this unpredictability might result in a surge of volatility throughout the inventory market — and given how Bitcoin has an in depth correlation to the tech-heavy Nasdaq 100, pullbacks could possibly be expensive.

The submit 7 Unanswered Questions for Crypto Below Donald Trump appeared first on Cryptonews.