Brazil is advancing its Central Bank Digital Currency (CBDC) initiative, Drex, by integrating decentralized finance (DeFi) elements into the project.

The latest initiative aims to modernize Brazil’s financial infrastructure and has introduced new phases of experimentation that incorporate DeFi concepts into the CBDC framework.

Roberto Campos Neto, President of Banco Central do Brasil, discussed these advancements on October 3, 2024. He highlighted Brazil’s desire for a multidimensional CBDC that addresses the challenges of decentralization, privacy, and programmability.

Brazil Leveraging DeFi In Their CBDC Pilot Program: Drex

In his presentation, Neto explained that Drex is designed to tackle a long-standing financial challenge: the “trilemma” of decentralization, privacy, and programmability.

According to Neto, the new CBDC must successfully balance these three elements to create a transformative digital currency that goes beyond the traditional use cases of CBDCs.

Neto said:

“We wanted to have three dimensions of benefits that you cannot get on just a normal CBDC,”

He explained that Brazil is looking into integrating tokenization directly into banks’ balance sheets.

The tokenization concept enables assets such as government bonds and real estate to be traded, verified and settled using blockchain technology.

The Drex project also benefits from the Open Finance initiative, an expansive platform that aims to foster competition among financial service providers in Brazil.

This platform is expected to integrate seamlessly with the CBDC, providing a marketplace where users can select from a range of financial institutions and payment methods, including CBDC-based services.

The long-term goal is to accelerate the country’s shift toward a tokenized economy, where both public and private assets can be freely exchanged using blockchain technology.

Phase 2: CBDC Testing and DeFi Integration

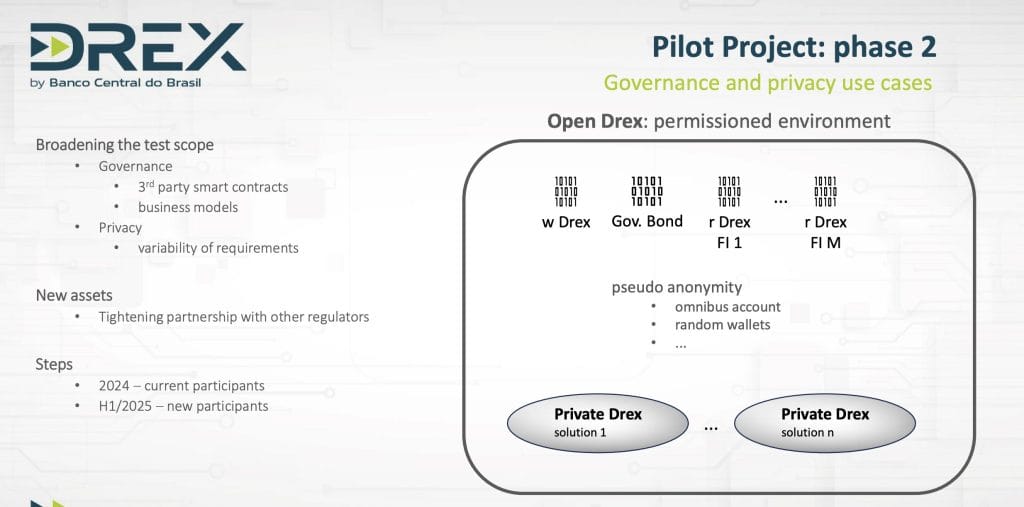

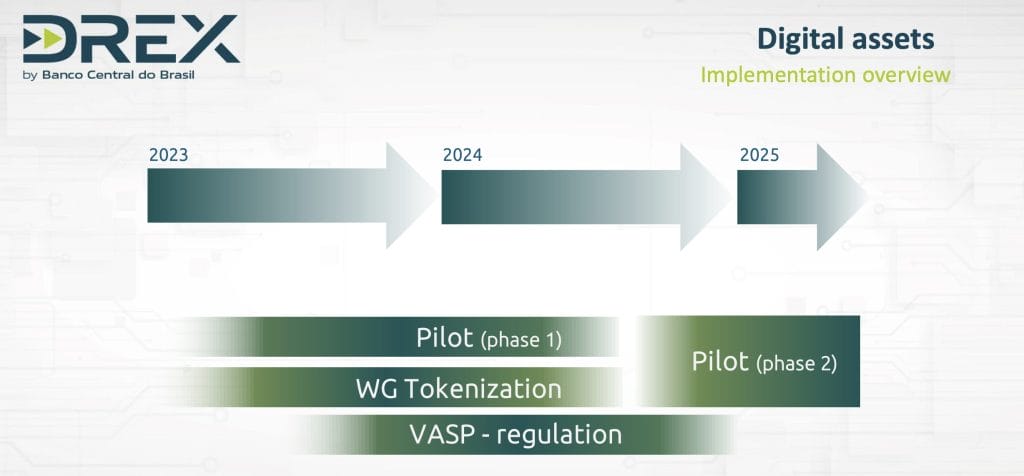

Brazil’s ongoing CBDC pilot has entered its second phase, focusing heavily on digital asset transactions and exploring the potential for DeFi integration.

This phase is particularly crucial for testing liquidity pools for government bonds and mechanisms for international trade finance.

According to Banco Central, these tests will extend into 2025, with no fixed deadline, allowing the government to refine the system and address any challenges that arise.

During the pilot’s first phase, Brazil experimented with decentralized elements in Drex.

The current second phase is more focused on real-world applications, including asset tokenization and DeFi liquidity mechanisms.

This effort is a significant departure from the traditional, slower-moving financial infrastructure that has been in place for decades.

Brazil is also making strides in interoperability between Drex and DeFi ecosystems.

The aim is to bring DeFi principles under regulatory oversight, allowing DeFi markets to operate within a controlled environment.

In addition to these public-sector efforts, private crypto firms are also expanding their footprint in Brazil.

Ripple, for example, has partnered with Mercado Bitcoin to introduce cross-border payment solutions, which will allow businesses in Brazil to make quicker and cheaper payments globally.

Banco Central do Brasil has been working closely with other financial regulators to ensure that the new CBDC aligns with existing regulations while also creating room for innovation.

Notably, the recent ban of X (formerly Twitter) in Brazil, ordered by the Federal Supreme Court, has severely impacted the country’s crypto community, which relied heavily on the platform for real-time updates on digital assets and regulatory developments.

As X becomes inaccessible in Brazil, crypto investors are left searching for key market updates. Decentralized platforms like @farcaster_xyz may offer an alternative. #BrazilCrypto #DecentralizedSocialMediahttps://t.co/MHWJggchrt

— Cryptonews.com (@cryptonews) September 19, 2024

With over 24.3 million Brazilian users before the ban, X was a crucial source for disseminating information on topics.

Many professionals in the crypto sector, including researchers and influencers, have expressed frustration at the disruption, citing difficulties in accessing vital regulatory updates and market information.

The post Brazil Explores DeFi Integration in Drex CBDC Pilot appeared first on Cryptonews.